Increasing data demand, particularly driven by the rollout of artificial intelligence (AI), has necessitated the rapid development of data centre processing and storage capacity globally. This rapid growth in data centre development has caused a step change in power load demand, creating some challenges for network operators and independent power providers (IPPs).

Despite the challenges, 4D believes that the step change in load demand required by new data centre and hyperscale developers presents a significant opportunity for infrastructure investment across multiple sectors.

Introduction

The surge in internet users, which has tripled over the past decade, underscores the unprecedented expansion of digital utilisation, with data consumption skyrocketing by 25x from 2010 to 2022. Data centres are central to the global digital economy, supporting a multitude of industries. These critical data hubs form the foundation of the digital ecosystem, facilitating the computation, storage, and flow of information that drives businesses, supports consumers, and stimulates technological innovation.

There have been waves of compounding data centre growth over the past few decades.

- Phase 1 was aligned with the increased utilisation of the internet.

- Phase 2 was driven by the roll-out of decentralised cloud computing.

- The current phase is being driven by the proliferation of artificial intelligence (AI) and its usage in generative AI (Gen AI).

AI recently excited investors with its potential application across virtually every industry. It has also ignited demand for the technology to support it, such as new generation processing technology, communication towers and data centres infrastructure. What has been somewhat overlooked by investors is that power and energy are the lifeblood of AI, and the associated roll-out of data centres.

The AI phenomenon and further development of data centres

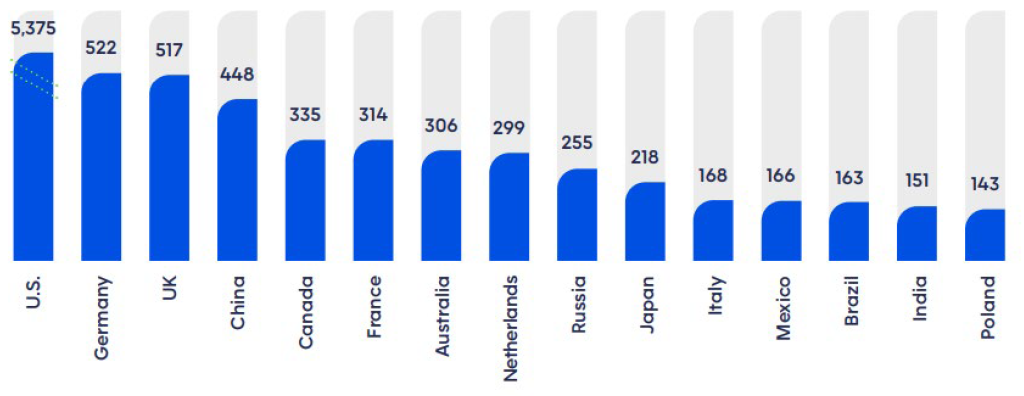

Data centre build out has been rapid over the last decade, with the number of data centres globally as at 30 September 2023 depicted below.

Source: PS Market Research, SDxCentral, Statista Market Insights

The roll-out of AI will require enhanced processing technology within data centres, such as next generation processors, which have the capacity to process data on a magnified scale. This new processing technology, and the more advanced cooling technology required to support it, have both driven increased data centre development across the globe. Cutting edge data centres that utilise new processing and cooling technology to facilitate AI include the hyperscale data centres.

Traditional co-location data centres are established to meet the varying needs of multiple customers within a single data centre facility. By contrast, hyperscale data centres are usually much bigger data centres in terms of capacity and are designed to meet the specific technical and operational requirements of companies like Amazon, Meta, Google, Alibaba, IBM and Microsoft. These same hyperscale companies leading the AI revolution, are driving exponential growth in data centres.

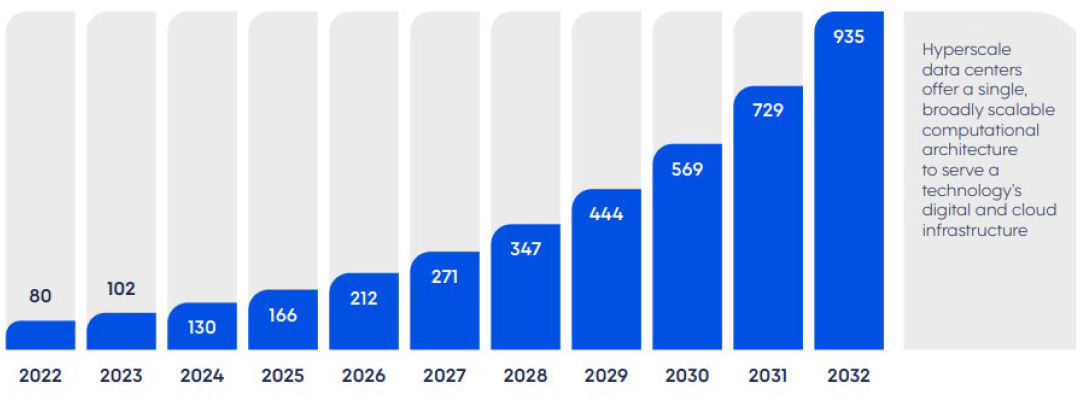

Analysis by Synergy Research Group has showed that about 20% of global data centre capacity is already dedicated to AI. The global hyperscale data centre market is estimated to reach approximately $935.3 billion by 2032, with a forecast CAGR of 27.9%. The graph below indicates the forecast global revenues from hyperscale data centre developments.

Source: Whiteshield and Khazna

Expected load demand growth

AI processing technology is developing rapidly, as is the requirement for cooling of this new technology. According to the International Energy Agency (IEA), processing power accounts for about 40% of a data centre’s power needs; while cooling requirements to achieve stable processing efficiency makes up another 40%. The remaining 20% comes from other associated IT equipment.

The introduction of AI technology increases the average power utilisation of a rack[1] within a data centre from around 8 kW per rack in 2020, to 40 kW/rack for more modern processor racks (typically used for cloud computing), and up to 132kW/rack for liquid cooled latest edition Nvidia processors. This means the energy intensity of a data centre with the same amount of racks has increased between 5-15x since 2020.

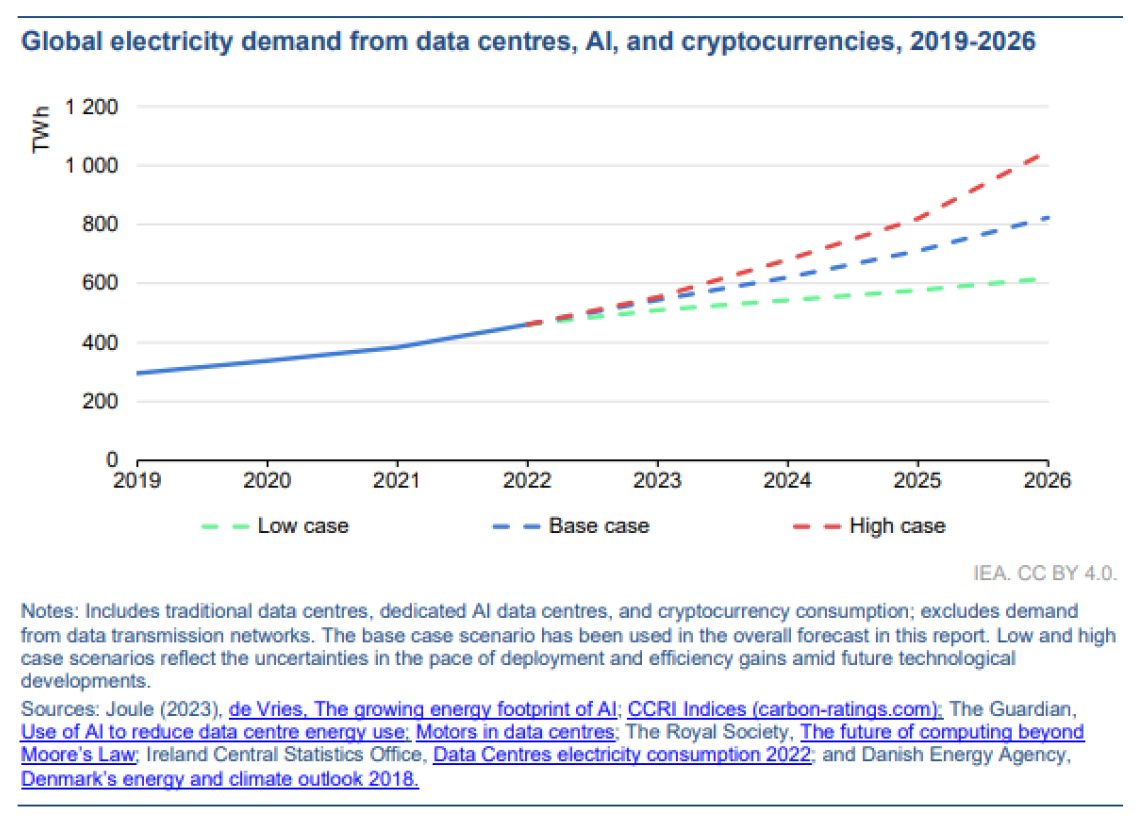

Future trends of the data centre sector are complex to navigate, as technological advancements and digital services evolve rapidly. Depending on the pace of deployment, the range of efficiency improvements, AI and cryptocurrency trends, and impediments to development, the IEA expects global electricity consumption of data centres, cryptocurrencies and AI to range between 620-1,050 TWh in 2026, with the base case for demand at just over 800 TWh – up 74% from 460 TWh in 2022 (almost 2% of total global electricity demand). This corresponds to an increase in power demand roughly equivalent to Germany.

Source: IEA: Electricity 20204 – Analysis and forecast to 2026

Country-specific experience of data centre load demand

There are currently more than 11,879 data centres globally, with about 45% of these located in the United States, 29% in Europe, 15% in the APAC region, and 5% in Latin America[2]. These data centres currently consume 1-2% of overall power, and according to Goldman Sachs, data centre power demand will grow 160% by 2030, accounting for 3-4% of power demand globally.

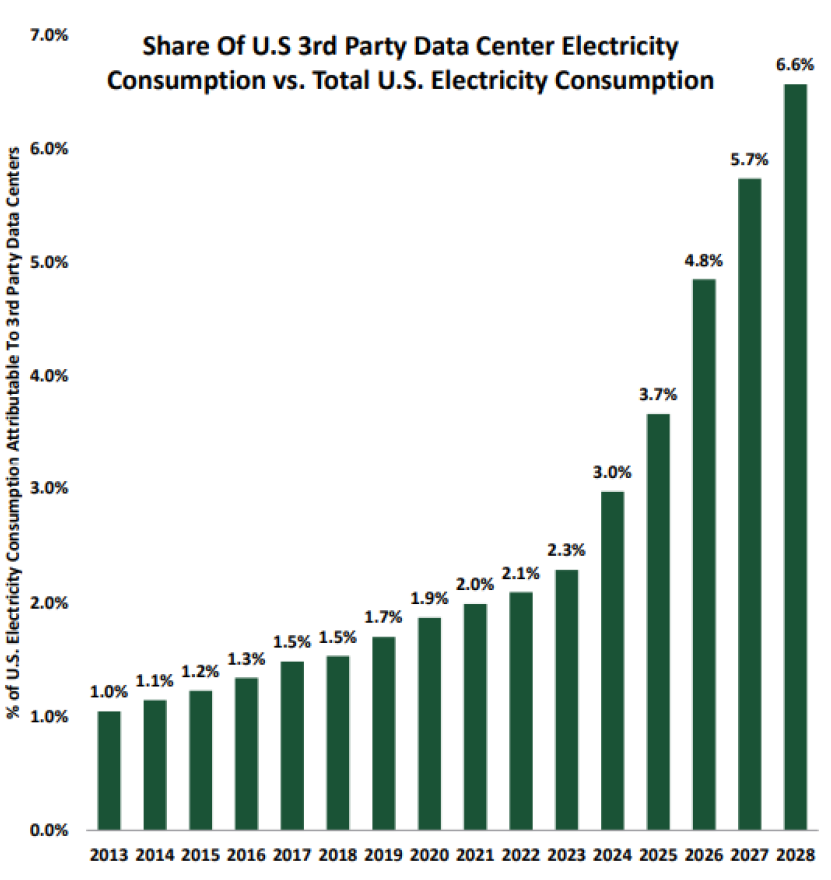

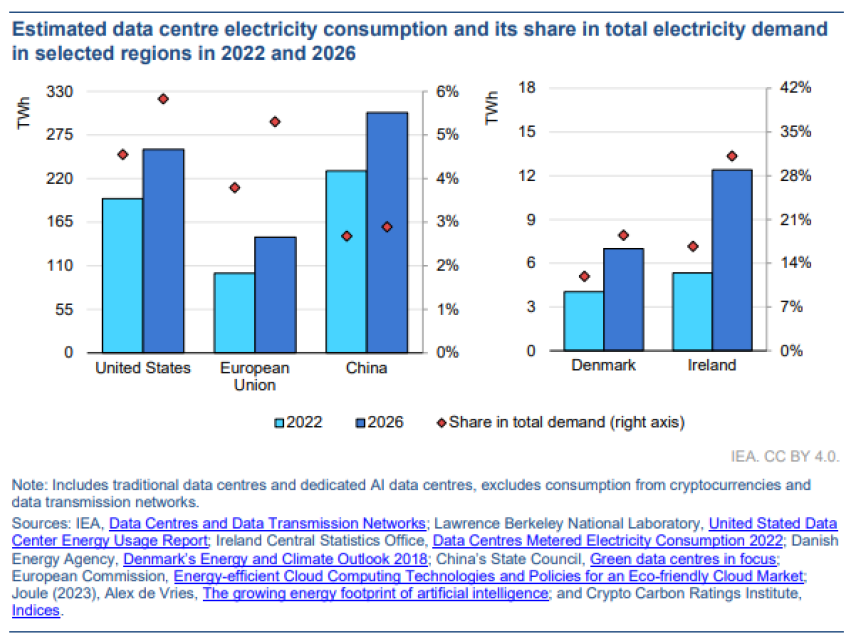

The US has been a clear leader in this evolution and is expected to continue to dominate. US co-location (third party) data centre electricity consumption is expected to grow at a rapid pace in the coming years, increasing from around 200 TWh in 2022 (~4% of US electricity demand), to almost 260 TWh in 2026 to account for 6% of total electricity demand[3]. The accelerating electricity load growth tied to AI-driven data centre demand is driving power constraints - TD Cowen estimates co-location US data centres will represent 6.6% of 2028 US electricity consumption (vs. 1.5% in 2018) and Goldman Sachs see it at 8% by 2030, both forecasting exponential growth post 2023.

Source: US Energy Information Administration; 451 Research; TD Cowen

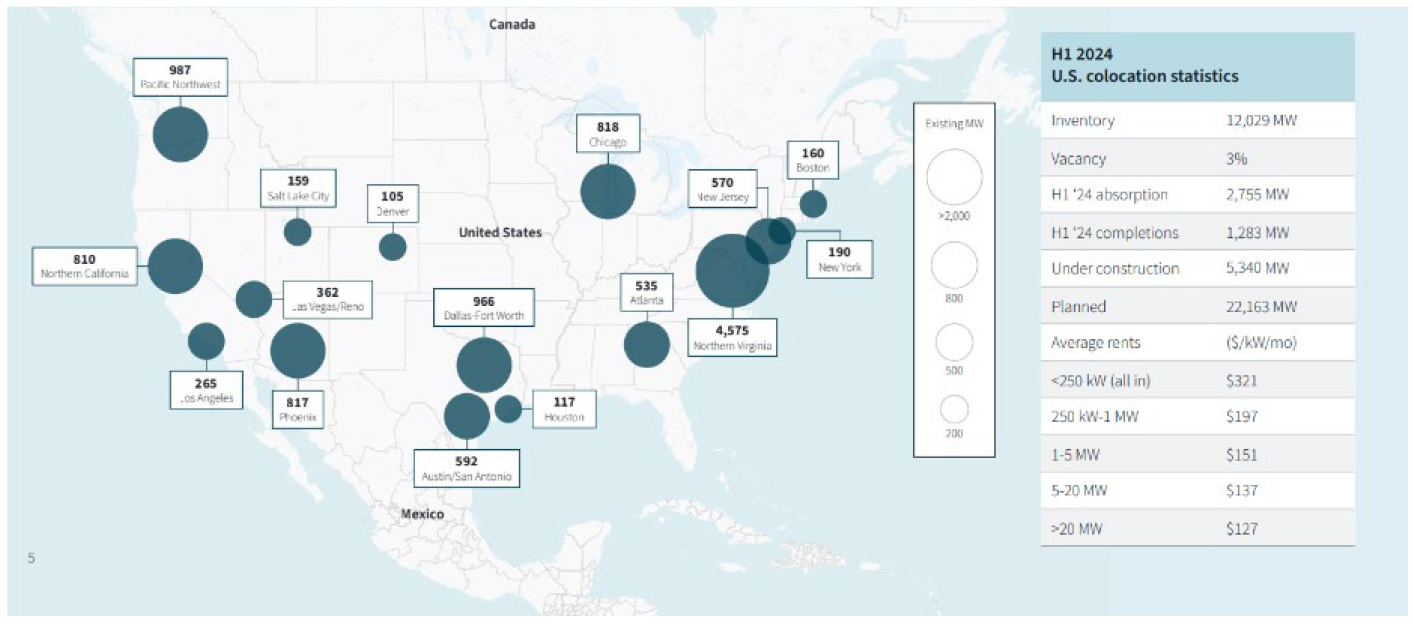

Different regions in the US are experiencing expedited growth in data centre development, and therefore power load growth. A map of data centres across the US is depicted below. Although data centre locations are distributed across the US, there’s obvious congestion in Northern Virginia.

Source: JLL: US Data Centre Report – Mid 2024

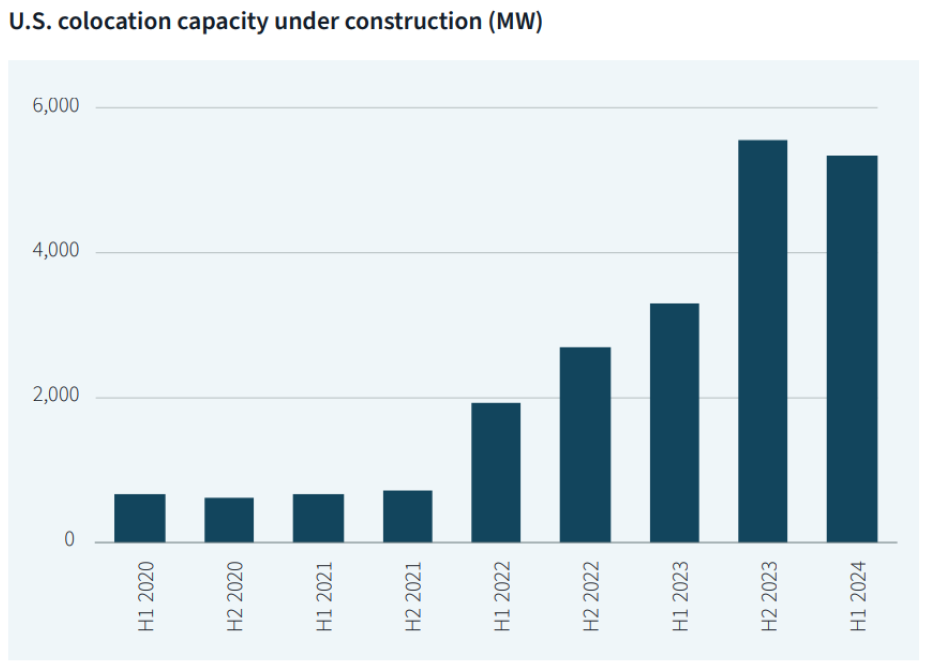

Co-location completions in the US increased to a new record of 1.3 GW in the first half of 2024. Around 40% of the completions were in the Northern Virginia market. Importantly, at the end H1 2024, the pipeline of co-location data centres under construction represented 5.3 GW of capacity. This pipeline of centres under development has grown significantly in recent years, as portrayed by the graph below. Justifying this strong pipeline of data centre developments is the fact that excess data centre capacity is difficult to come by. Co-location vacancy rates are around 3.0% as at the end of H1 2024 and have been trending down from 9.9% in H1 2020.

Source: JLL Research

Data centre electricity consumption in the European Union (EU) is estimated at slightly below 100 TWh in 2022, almost 4% of total EU electricity demand. Around 1,240 data centres were operating within Europe in 2022, with the majority concentrated in the financial centres of Frankfurt, London, Amsterdam, Paris, and Dublin. With a significant number of additional data centres planned, as well as new deployments that can be expected to be realised over the coming years, forecast electricity consumption in the data centre sector in the EU will reach almost 150 TWh by 2026 according to IEA forecasts.

Ireland is a particularly interesting case with data centre load demand of approximately 5.3 TWh in 2022, representing 17% of the country’s total load demand. With anticipated growth driven by AI applications, data centres in Ireland are forecast to double their power consumption by 2026, which would represent around 32% of the country’s power demand at that point. This obviously creates some complications in the country which are discussed later in this article.

The European Commission established the Energy Efficiency Directive, which includes regulations promoting more transparency and accountability from the data centre sector in Europe to support electricity demand management. Starting from 2024, data centre operators and hyperscalers have mandatory reporting obligations on the energy use and emissions from their data centres, intent on meeting climate neutrality by 2030. Irrespective of whether the 2030 target is met, the new regulations should optimise the roll-out of data centres in Europe going forward. Spain could potentially be a benefactor of the need for data centre developments for readily available, clean power (see case study of Iberdrola below).

Europe needs more than $1trn to prepare its power grid for AI. It has the oldest power grid in the world, and Goldman Sachs forecast the need for ~€800bn in spending on transmission and distribution over the coming decade, as well as ~€850 bn in investment on solar, onshore wind, and offshore wind energy to support data centre growth.

China's State Grid Energy Research Institute expects electricity demand in the country’s data centre sector to double to 400 TWh by 2030, compared to 2020. Regulations are being updated to promote sustainable practices in current and future data centres to align them with decarbonisation strategies. A major source of data centre growth is expected to come from the rapid expansion of 5G networks and the Internet of Things (IoT).

Source: IEA: Electricity 20204 – Analysis and forecast to 2026

Electricity demand has seen a full recovery across Southeast Asia since Covid, even before the impacts of significant datacentre/hyperscalers, semiconductors, new supply chains in energy/chemicals and electrification. In Malaysia, Tenaga reported an all-time high for commercial power demand in 2Q24, 7% above its pre-Covid peak. Data centre demand and a step up in industrial demand is likely to absorb excess power supply in Malaysia and Thailand, while this is also likely to keep electricity markets tighter for longer in Singapore and the Philippines through 2030[4].

Malaysian regulators have indicated the intention for increased long-term investment to harden the grid, to make it ‘renewables’ ready, along with the ability to adapt to bi-directional power loads from rooftop solar. This should boost transmission and electricity distribution investments for much longer, at 1.5x that achieved over the past decade and raise tariffs for commercial users of power. Malaysia is also seeing increased foreign direct investment, which is key to boosting power supply growth to 4% sustainably – c.2x the past seven years' growth rates.

Latin America is considered a prime destination for hyperscale data centre development, with relatively plentiful clean energy capacity available, access to water for cooling and low development costs. With latency less important for hyperscale and AI-focused data centre development, Latin America (specifically Brazil) could be considered a prime location for global hyperscale needs. According to JLL Research, data centres in Brazil currently have a total inventory of 777 MW in operation (67% in Brazil), double the size in 1Q20, another 472 MW under construction, and 468 MW planned - totalling 1.7 GW.

Considerations facilitating data centre developments

The development of data centres, most significantly hyperscale, is happening at a rapid pace. The incremental power demand and strain that this places on the whole electrical network are significant. Some network operators and utility companies globally are struggling to facilitate this significant incremental load from data centres, while ensuring that the associated development costs will not cause affordability issues for other customers. Utilities are actually looking to ensure that the new data centre load is a benefit for other electrical service customers, which requires negotiation and planning on behalf of the utility companies.

Community concerns related to data centre development typically include power scarcity, public costs, and water consumption. Data centre providers and hyperscalers believe that through community/stakeholder engagement and proper project design, many of these concerns can be alleviated and the benefits of a data centre investment can be fully appreciated.

Waiting time to facilitate load demand and interconnection

The lead time for a data centre interconnection to the grid will vary based on where the data centre is located. There are examples globally where constraints on available load supply and/or network (transmission and distribution) limit the interconnection of new data centre projects to the system, such as in Dublin, Ireland, and Northen Virginia.

Hyperscalers with load demand in excess of 25 MW are experiencing a wait of between two to seven years in the US for incremental supply to satisfy their operational needs. Based on TD Cowen recent checks, they forecast the lead times for procuring data centre power across the FLAPD (Frankfurt, London, Amsterdam, Paris, and Dublin) markets:

- 3-5 years in Frankfurt,

- 4-5 years in Paris,

- 3-5 years in Amsterdam,

- +10 years in London (absent buying reserved power from another operator), and

- Indefinite lead time in Dublin (Eirgrid is not accepting applications)[5].

Data centre developers are looking at alternative energy solutions such as fuel cells or supplemental natural gas turbines to facilitate projects on shorter schedules. The ability for data centres to operate as a microgrid can accelerate the development timeline as the grid’s main limitation is a lack of network capacity during peak demand – usually the summer season.

Hyperscalers in some cases have gone to lengths to secure power supply through directly contracting and connecting specific power generation facilities on co-generation sites. A recent example was in March 2024 when Talen Energy announced its sale of a 960 MW data centre to Amazon Web Services (AWS) for $650 million. The 1,200 acre campus is directly connected to and powered by the adjacent Susquehanna Steam Electric Station (nuclear facility), which generates 2.5 GW of power[6]. By contracting directly with the Susquehanna facility, AWS is able to obfuscate the network connection wait time.

Another example is Microsoft developing a 170 MW gas fired generation facility in Dublin to directly supply its operations, as the network operator outlined an ‘indefinite’ lead time in providing incremental power to data centres.

Location sensitivity of data centres in facilitating AI

Through the iterations of data centre development from facilitating internet, then to cloud, the importance of minimising latency has been central to the service proposition for customers. This latency minimisation requires deployment of data centres closer to major population centres where network density already exists. This led to a clustering effect that drives dense pockets of data centre power load in major metros, leading to localised transmission constraints.

Considering the exponential demand in the third iteration of data centre development to facilitate AI, despite deployments being much more power-intensive than their predecessors, they are not nearly as latency and location-sensitive. Albeit, to date hyperscalers have preferred to deploy data centres near major population centres due to the flexible use of the data centre capacity (if AI does not generate the returns hyperscalers need, they can repurpose the data centre capacity to support latency sensitive workloads such as cloud). However, as power constraints across markets grows, hyperscalers are looking to deploy capacity in more diverse areas.

In 2023, the rise of the ‘location agnostic’ data centre development reflects the lower latency sensitivity of the power intensive AI centres. There has also been a shift in the land acquisition strategies of hyperscalers as they look to build in less populated areas where power is available, and land is cheaper. A great example of this is Microsoft's acquisition of +1,000 acres in the Wisconsin Innovation Park, US, that will support a massive data centre campus where it will invest $3.3 billion in the next two years to support national cloud and AI infrastructure.

Power constraints in China began to emerge in major cities including Beijing, Shanghai and Shenzhen, which limited the ability of co-location data centre operators, including GDS, to secure power for new developments. As power constraints intensified, the Chinese government established the ‘Eastern Data, Western Computing’ plan in 2022. The plan looked to split latency sensitive workloads. Non-sensitive data centre projects, such as AI focused and/or hyperscale developments, were shifted to less densely populated regions in the western part of China, where there was greater land available and access to renewable power[7].

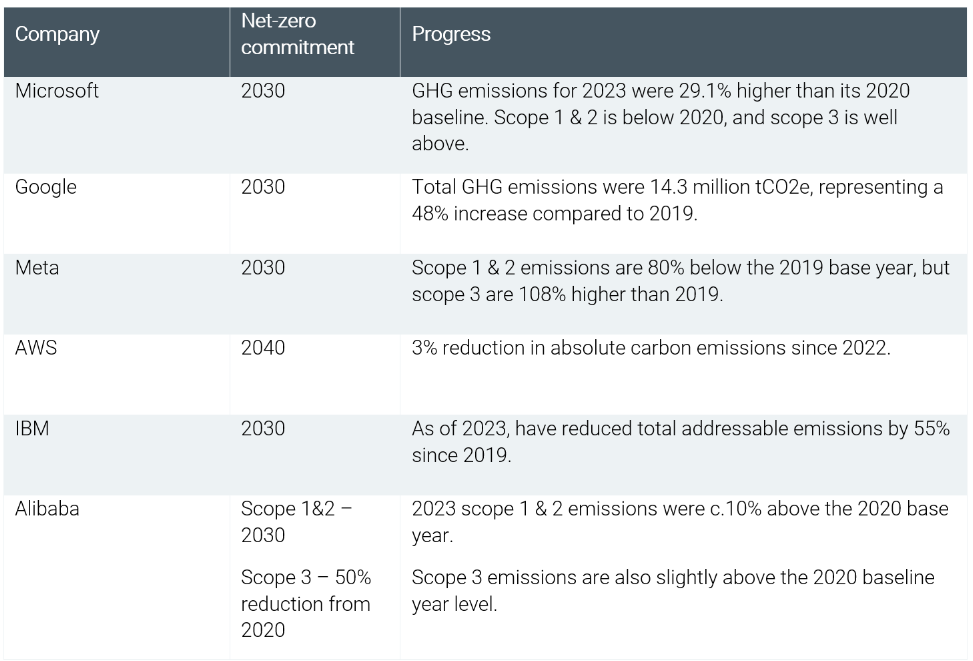

Hyperscalers need for uninterrupted capacity with commitment to clean energy

Data centres operate around the clock, so have a requirement for consistent, uninterrupted load. Many of the large hyperscalers have also made ambitious commitments to net-zero, which are summarised in the table below.

Source: Company websites and sustainability reports

The requirement of data centres, especially hyperscalers, to achieve speed to market to satisfy the surging demand for services such as AI, can be in conflict with the above net-zero commitments, where low/no carbon generation is intermittent or of low supply. The incremental load required by new data centre developments may or may not be immediately available on the network being connected to. As this incremental load will need to be available around the clock, it either needs to be baseload power – predominantly delivered by fossil fuels, or a combination of renewables, batteries, and/or gas. The other clean baseload power is nuclear generation, although it’s not readily available in most countries.

This can cause difficulties for major companies’ net-zero ambitions, especially when considering the magnitude of incremental load they will consume in the short/medium term through data centre developments. This does provide an opportunity for some infrastructure sectors such as natural gas midstream pipeline companies, with increasing global gas volumes required to provide baseload power and support renewable generation for data centre demand.

Opportunities for infrastructure companies

The incremental load demand requirements of data centres are creating a challenge, but also an opportunity for network utilities and IPPs across the world. The incremental load required by data centres globally is going to drive:

- additional generation development opportunities, probably at higher power prices (as supply catches up with demand);

- network investment to facilitate interconnections; and

- investment in network modernisation to support higher peak network load.

The obvious beneficiaries are IPPs who will target data centre developers and hyperscalers to construct generation to fulfill their requirements, or contract existing supply available in merchant markets at higher prices than is currently available. Hyperscalers need for speed to market, and uninterrupted security of supply has meant that they have been willing to offer PPA prices in excess of what is available in current merchant markets. This has been shown by Microsoft contracting separately with Constellation Power for nuclear energy is being contracted at prices rumoured to be far above the $60/kWh futures price for 2026[8], which is currently prevailing in the PJM zone merchant price market in the eastern US. Analysts predict these prices could reach as high as $100/kWh.

Electric network utility companies are the other clear beneficiary. They derive regulated or contracted earnings streams linked to the investment made into a network. They are beneficiaries of the need for investment in new connections and network augmentation to facilitate the higher peak loads driven by data centre load demand. This additional investment is often recovered through regulatory mechanisms which provide a set return on the incremental investment. This investment needs to be largely financed in debt/equity markets, which can dilute the returns to shareholders, but if remunerated with a ‘reasonable’ regulatory return, incremental investment should benefit existing shareholders.

If utility companies bill data centre customers correctly (often with contractual commitments), incremental load demand from data centres can be beneficial to existing electric network customers by sharing the fixed cost of the network across a broader customer base. All else equal, this should lower electricity network bills of typical residential and commercial customers, improving their affordability. This is obviously appreciated by customers, and the institutions regulating network utility returns, supporting the social license under which electric utility companies operate, and reducing regulatory risk for shareholders.

Midstream gas companies supporting increased gas volumes

As outlined above, the requirement of data centre developers and hyperscalers for security of supply, and speed to market is likely to require increased natural gas fuelled generation, and gas volume demand. Despite the longer-term net-zero ambitions of developers and hyperscalers, the required transportation of increased volumes of natural gas is likely to provide opportunities for natural gas midstream companies.

Natural gas demand has largely benefitted from coal fired plant retirements over the past decade, offset to some extent by efficiency gains. As at Q2 2024, US gas power supply demand YTD is already up 4% vs 2023 levels, or about 1.3 Bcf/d - approximately 40% of which is derived from data centres. Data centres alone now total roughly 2.0 Bcf/d of total natural gas demand. The market for US natural gas is currently in steep contango[9] with 2025 NYMEX pricing averaging $3.49/Mcf and $3.92/Mcf in 2026 vs. $2.54/Mcf for 2024, reflecting the balancing of near-term oversupply with long-term expectations for demand growth by: 1) LNG expansion, and 2) domestic power burn due to AI/data centre proliferation[10].

Higher futures gas prices should drive increased gas production globally. Gas midstream companies are preparing for these higher prices and production by investing in infrastructure to support increased volumes being delivered to generation facilities owned by IPPs and utilities.

Growing data is good for towers companies

The proliferation of AI, and the associated rollout of data centres, is expected to go hand in hand with the rollout of 5G telecommunication data demand. Data demand is expected to grow significantly, primarily driven by data-intensive activities such as video streaming, cloud gaming and augmented/virtual reality applications, and AI. Mobile data traffic is projected to quadruple by 2028 compared to 2022. 5G’s share of mobile data traffic is projected to rise to nearly 70% in 2028, up from around 17% in 2022[11].

This strong data demand will likely support higher utilisation of telecommunications towers by mobile network pperators (MNOs) such as AT&T, Verizon, Vodafone, Deutsche Telecom, Movil and T-mobile, to support densification of data coverage (this is allowing for larger data volumes through more high frequency antenna coverage). Higher utilisation per tower or tenancy provides earnings growth for tower companies with minimal, if any, incremental capital investment.

Best ways to play the opportunity

Dominion Energy (D-US)

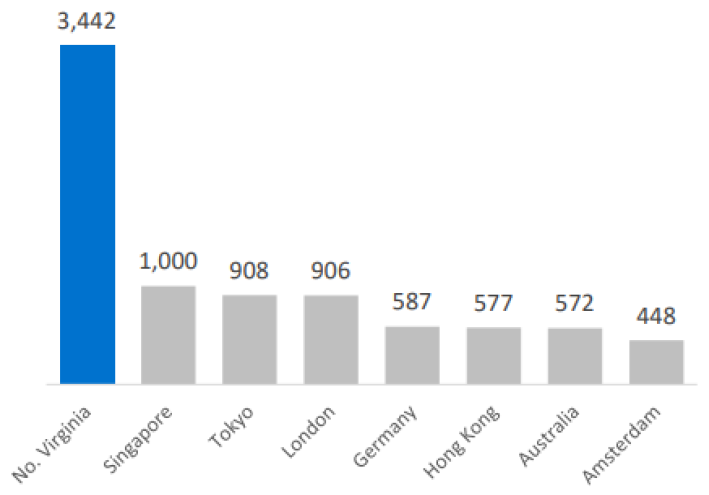

Dominion Energy (Dominion) is the incumbent utility that operates in Virginia. Included in its operating jurisdiction is large parts of Northern Virginia which is home to the largest data centre capacity of any city in the world (shown below). Northern Virginia is poised for unprecedented load demand growth driven completely by anticipated data centre development.

Northern Virginia data centre capacity versus select international cities

Source: JLL data centres outlook 2023

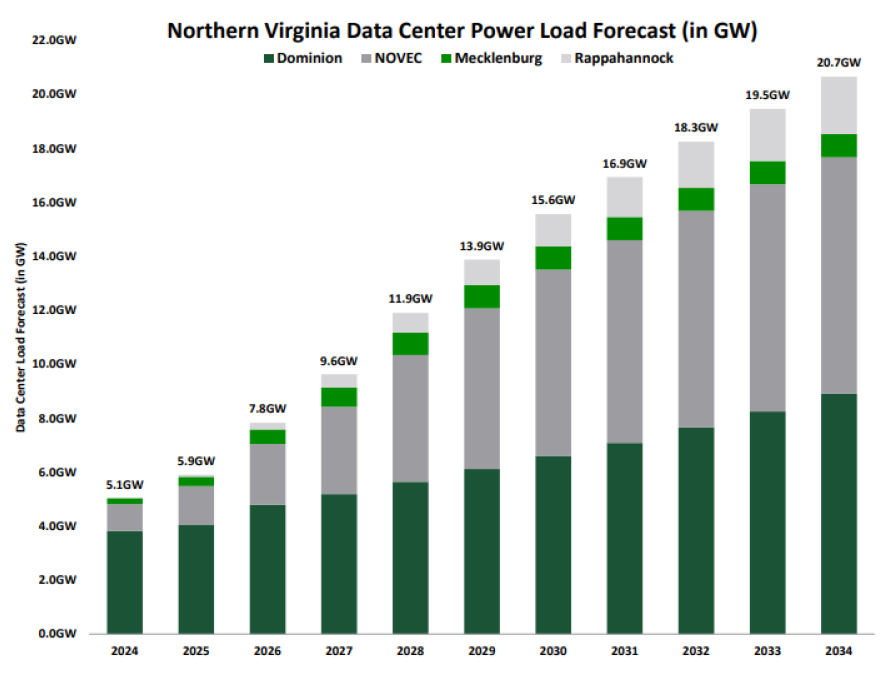

PA Consulting developed the below power load forecasts for utilities which operate in Northern Virginia, including Dominion. This forecast incorporates data centre developments which are currently being constructed or are close to begin construction with a high certainty of delivery. It shows that power load is expected to roughly double in Dominion’s operating jurisdiction between 2024-2034.

Source: PA Consulting

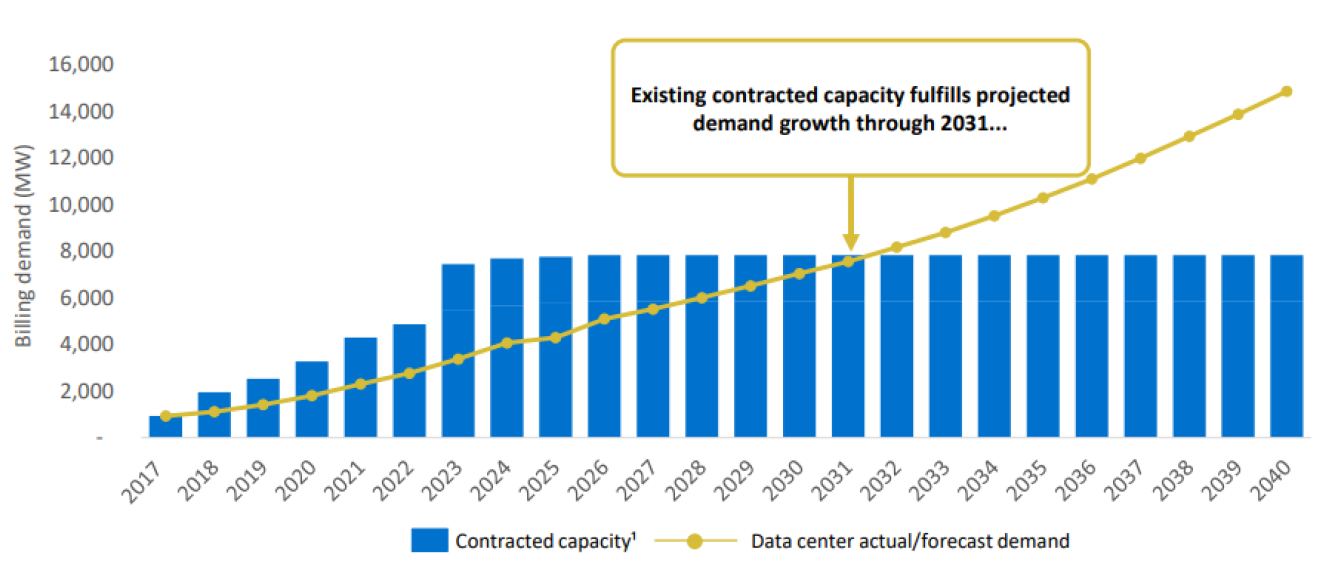

Dominion has presented its own expectations for data centre driven load growth (below). It’s a little more aggressive than PA’s view as to load demand in 2034 – PA c.8 GW vs Dominion c.10 GW. Management have outlined upside potential through data centre developments not included in the company forecasts, that have incurred planning costs.

Source: Dominion Energy

This anticipation of a significant increase in load demand is driving the necessity for capital investment in generation and to support capacity and modernisation of the network. Dominion’s current five-year capital plan, which covers the years 2025-2029, incorporates $6.8 billion in solar, storage and offshore wind generation; $3.6 billion on existing nuclear generation; $12.2 billion in electric transmission; and $3.4 billion grid transformation and modernisation – total capital investment in Virginia and North Carolina is expected to be $35.5 billion. Dominion will be updating its capital plan again in late 2024, and are expected to incorporate a greater proportion of data centre required capacity. It’s unclear at this stage whether additional capital will increase the company’s current rate base growth forecast of 7.5% CAGR in Virginia, and/or whether the investment will primarily elongate rate base growth further into the future.

Dominion management has indicated that a significant uplift in capital investment is likely to require additional equity for financing purposes. The cost of equity and debt financing of this investment will influence whether the company is able to outperform its current earnings per share (EPS) growth guidance of 5-7%.

Data centre load demand not only provides incremental growth potential for investors, if implemented correctly, it should support electric service affordability for the remainder of the customer base. Data centre’s financial contribution is to pay for the incremental power load they require, but also provide a contribution to the socialised cost of the interconnecting network.

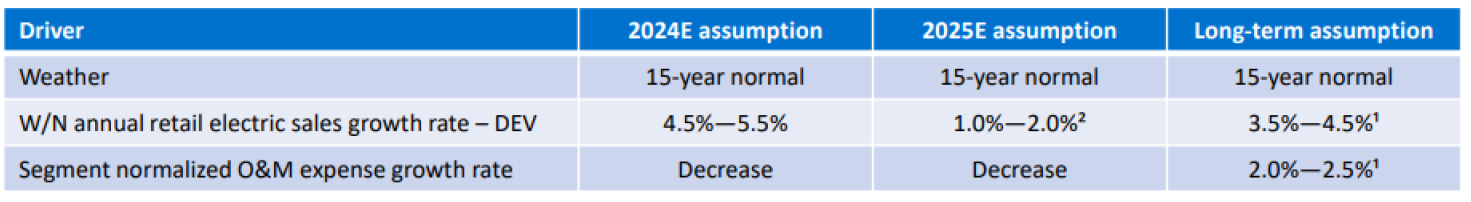

Dominion management outlined, “since 2020, residential customers’ allocation of transmission costs has declined by 10%, while the largest energy user class, GS-4 allocation has increased by 9% driven by data centres”. They also provided the information in the table below outlining load demand growth in excess of O&M expense growth, will provide scale benefits and reduce per metric unit cost of power supplied.

Source: Dominion Energy

Improved residential customer affordability is a key focus for regulators. Support provided through data centre load growth in Northern Virginia is appreciated by the Virginia State Corporation Commission (SCC). This reduces regulatory risk generally for Dominion and its investors, and enhances the social license the company has with customers and the regulator.

Iberdrola SA (IBE-ES)

Iberdrola is one of the largest and most advanced providers of clean energy globally, with a strategy very much focused on facilitating the global energy transition. The company is based in Spain, but has energy network investments across Europe, the US and Brazil, as well as predominantly clean generation assets in broader locations across the world.

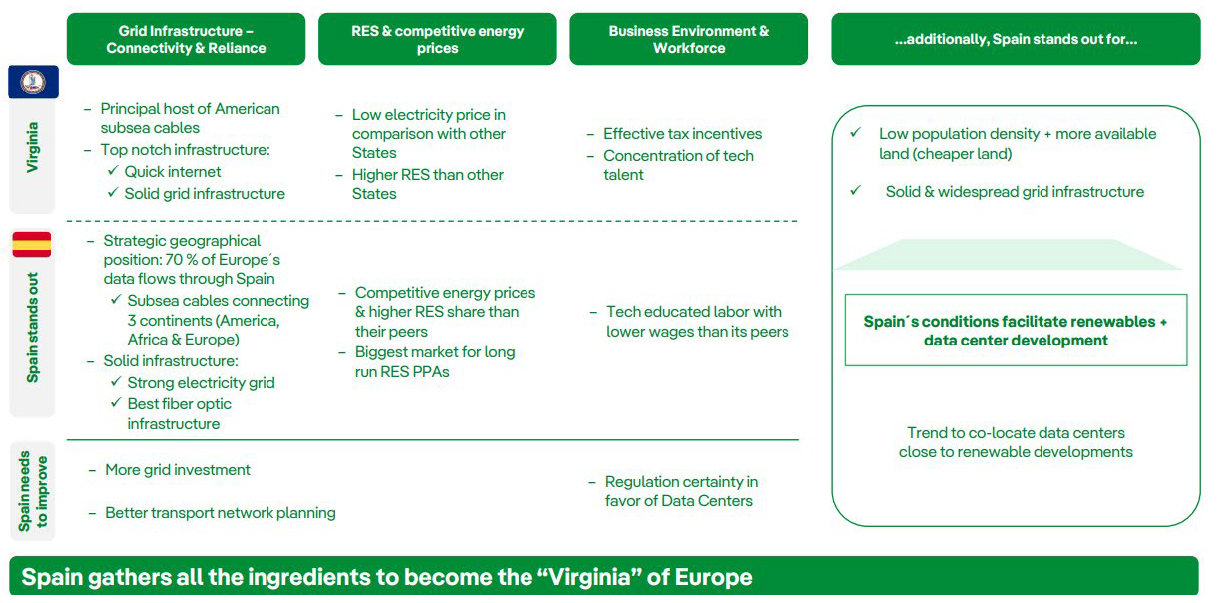

Iberdrola believes Spain could become a hub for data centre developers because of its strategic positioning in Europe, solid infrastructure and competitive energy prices. They provided the below chart comparison to Virginia (the data centre capital of the world).

Source: Iberdola

Management believes that Spain’s relatively plentiful access to renewable energy; land availability; fibre connectivity throughout Europe and globally (important for data centres); access to electrical grid connectivity and cost competitiveness in terms of civil development and human resource cost, is all supportive of the wide scale development of data centres. As outlined above, Iberdrola have identified the need for grid investment, and regulation certainty as requirements to improve the data centre penetration in Spain.

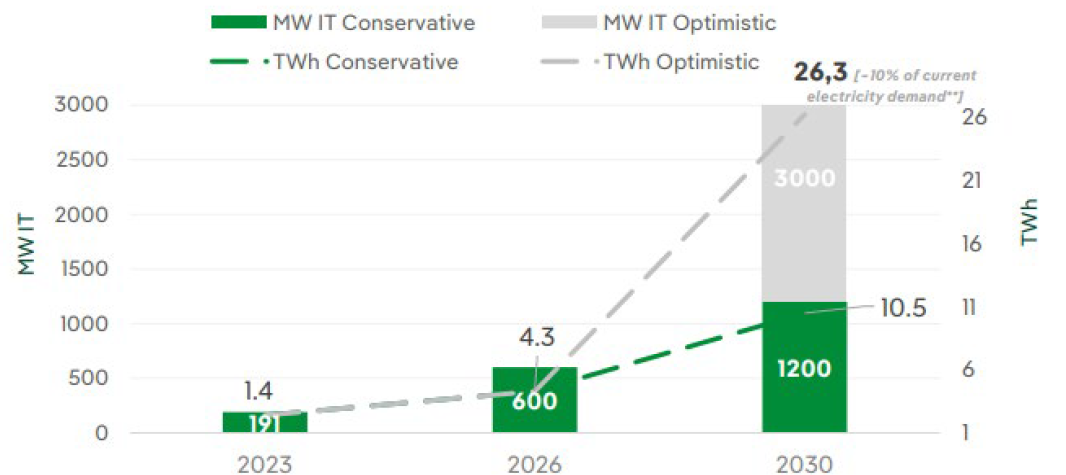

Forecasts developed by Iberdrola with support from Morgan Stanley and Goldman Sachs suggests that data centre load demand even under a conservative scenario is expected to grow 3.0x by 2026 (compared to 2023) and 7.5x by 2030. Including assumptions around the potential for AI penetration and load demand, growth by 2030 could be nearly 19.0x (depicted below).

Source: Data centre demand growth in Spain; Iberdrola, Morgan Stanley, and Goldman Sachs

Iberdrola identified the load demand driven by data centres across jurisdictions, and the desire for clean (low/no carbon) energy, as a great opportunity for the company. It believes its expertise in generation development, and network interconnection provides a solution for the energy requirements of new data centre developments, especially hyperscalers. As such, in September 2024 it launched a new company, CPD4Green, to facilitate 24/7 green power for data centre developments. Its intention is to establish strategic relationships with data centre developers and hyperscalers to fulfill its clean energy requirements. It’s also looking for a financial partner to support the project[12].

Iberdrola believes they are well-placed to become an integrated data centre developer through its strategic partnerships and CPD4Green. Iberdrola currently has 22 GW of renewable energy capacity in Spain and is a leader in energy storage, which is essential to facilitate the 24/7 power needs of data centres. There are few other energy providers or jurisdictions globally that can offer the combination of excess low/no carbon generation, that is non-intermittent (that is provided 24/7). It is leveraging its global relationships with developers and hyperscalers, and are progressing a pipeline of data centre sites, having made interconnection requests to distribution and transmission operators, of which it is one. It has already secured 200 MW of power connection in the south of Madrid with more than 16ha of land plots suitable for the development and construction of data centre projects.

Iberdrola’s goal is to achieve a 20% market share in the forecast development of data centres in Spain (4D believes this is conservative) – 200MW capacity growth under a conservative scenario, and 600 MW under the more aggressive case. This implies run rate EBITDA of €150-250 million with no significant capital requirements of Iberdrola. The company will also earn margin through the PPA agreements with the JV partners for power provision. The anticipation is that the relationships developed with the data centre developers and hyperscalers, can be leveraged to other markets outside of Spain.

Tenaga Nasional Berhad (TNB)

Tenaga Nasional Berhad is Malaysia's largest electricity utility company, responsible for the transmission and distribution of electricity to customers across Peninsular Malaysia, Sabah, and the Federal Territory of Labuan. TNB holds a 51% market share of the country’s domestic electricity generation capacity. As the nation’s primary energy utility, TNB will play a pivotal role as Malaysia increasingly emerges as a hub for data centres.

The key opportunities from the proliferation of data centre development are again threefold: demand growth, investment in generation capacity to support this increased demand, and investment in transmission and distribution to facilitate the connection of data centres and potentially new generation sources.

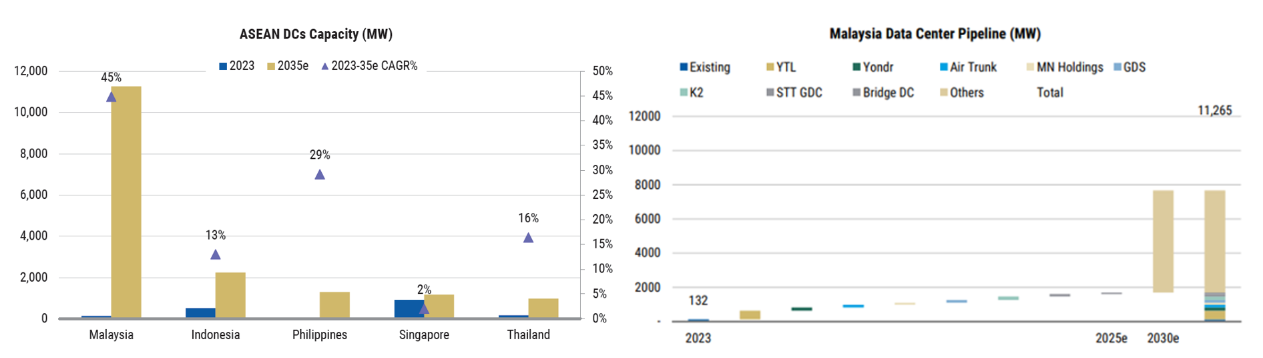

Malaysia has a data centre demand pipeline equivalent to over 11 GW of power demand, which compares to the country's current demand of 12 GW. If fully realized, this could effectively double the country’s existing energy demand. TNB aims to meet approximately 50% of this additional demand.

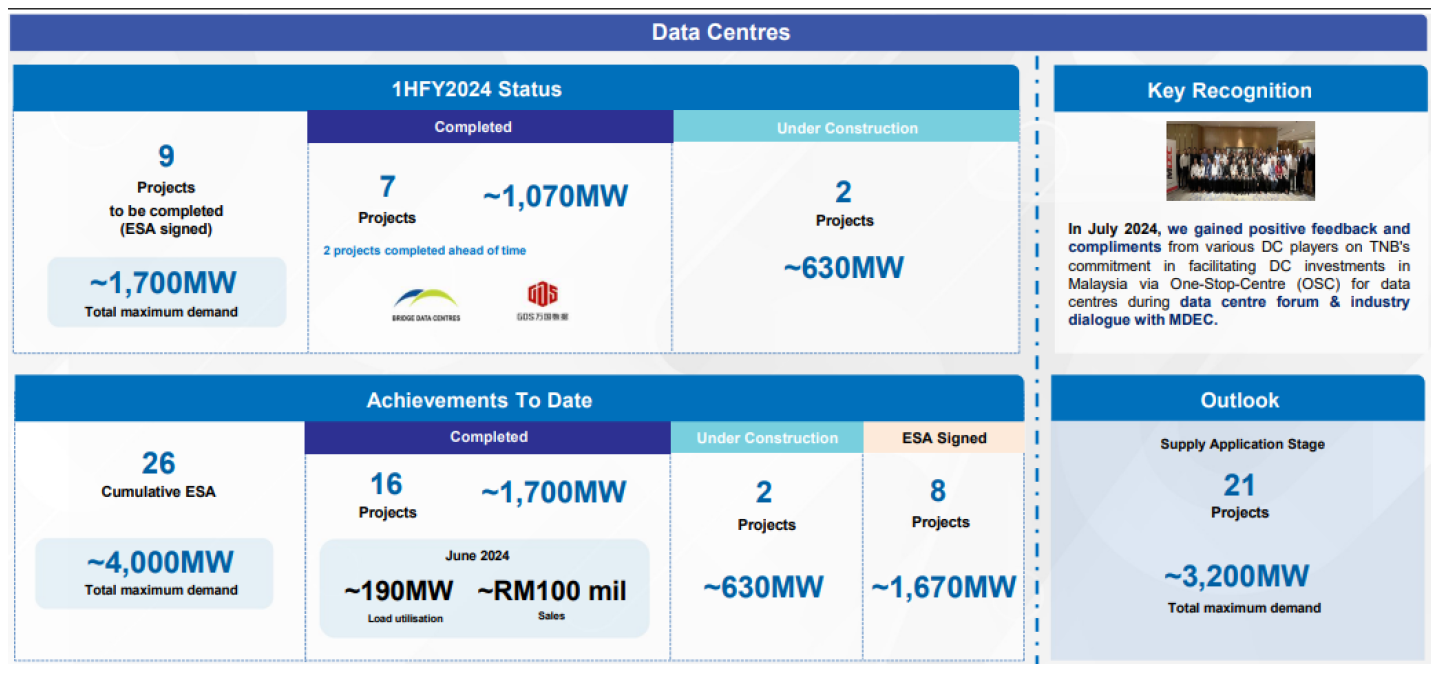

Source: Company Data, Morgan Stanley Research

TNB currently has cumulative data centre connections of 1.7 GW, with 4 GW of committed demand and another 3.2 GW in late-stage applications. It estimates that every completed 100 MW of data centre capacity contributes approximately RM600 million in annual revenue. The demand profile from data centre customers varies, with TNB noting that the total committed capacity will generally take five to seven years to fully ramp up. New data centre connections are required to pay a 25% initial investment to connect to the grid and face penalties if it does not meet annual load targets under take-or-pay arrangements.

Source: Tenaga Nasional

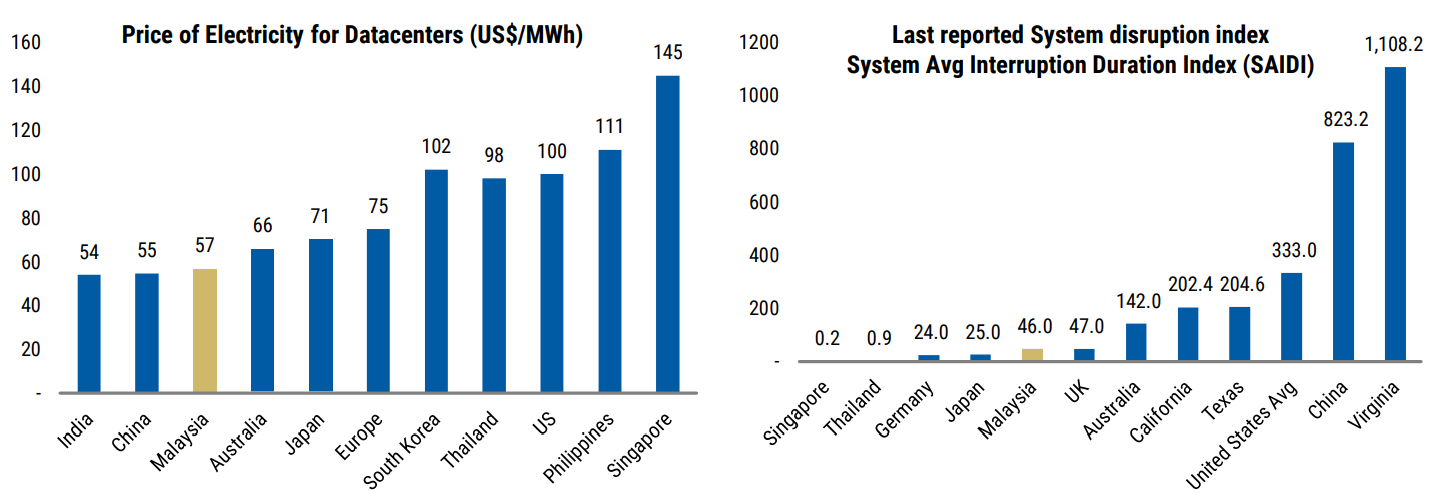

A combination of factors contributes to Malaysia’s attractiveness as a data centre destination, the most notable being: reliable power infrastructure with low disruption times, affordable and ample electricity supply (power reverse margin of ~30%), favourable regulations and policies, proximity to the major hub of Singapore, and access to microchips and processors.

Source: Morgan Stanley Research

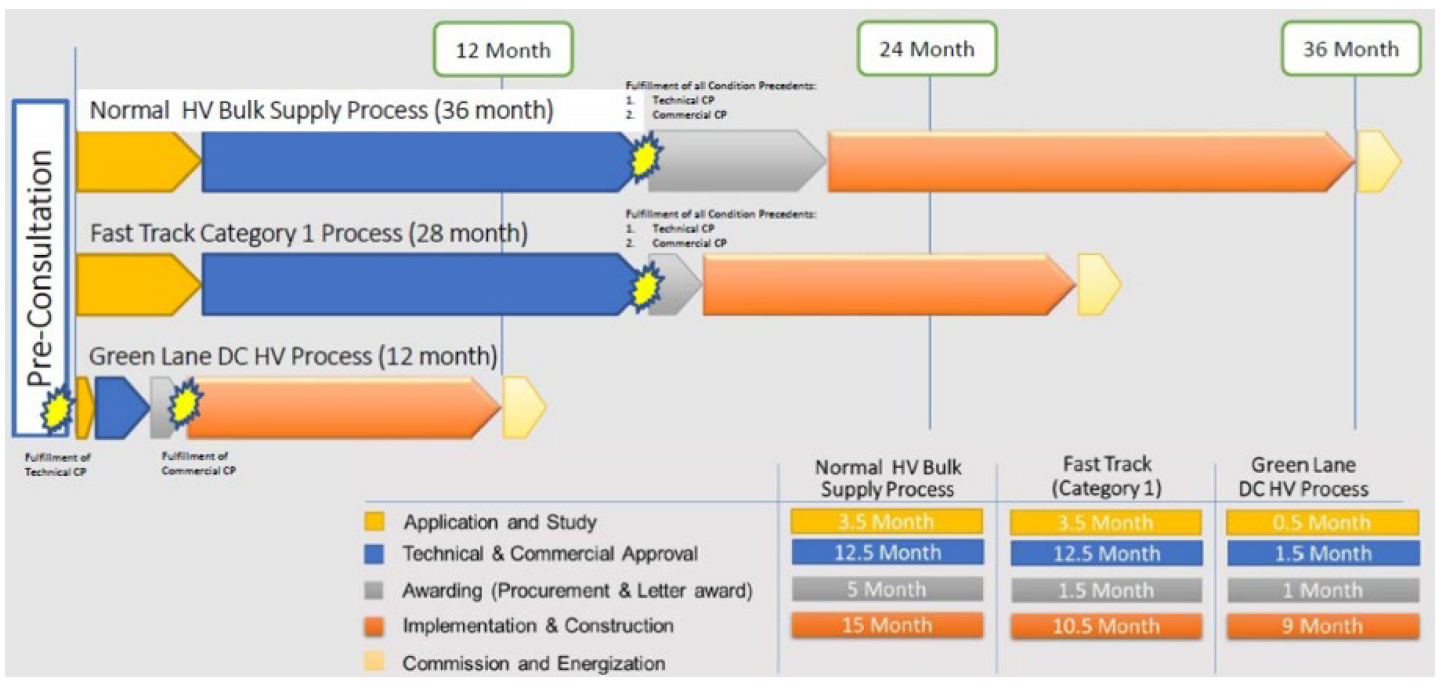

The regulatory environment plays a crucial role in shaping data centre deployment in the country, with both the government and utilities paving the way. Data centre customers may qualify for Malaysia Digital (MD) status. The Malaysia Digital Bill of Guarantees outlines various incentives, such as exemptions from foreign equity restrictions, allowances for employing foreign knowledge workers, income tax exemptions, investment tax allowances, and exemptions on import duties for multimedia equipment. To support the anticipated growth from DC demand, TNB established the “Green Lane Process,” which acknowledges the need for timely investments in grid infrastructure. This initiative significantly reduces the connection approval timeline from 36 months to just 12 months for data centres. This acceleration not only expedites revenue generation—through the incorporation of investments into the regulated asset base and additional demand from data centres—but also ensures that the needs of the evolving data centre sector are met.

Source: Tenaga Nasional

TNB has announced an indicative capital expenditure requirement of RM90 billion over the next six years (2025-2030), implying an annual run rate of RM15 billion, up from RM10 billion in the previous six years (2017-2023). Noting that this investment is not solely allocated to facilitating data centre development; it also supports robust demand growth and energy transition initiatives. Additionally, the investment deployed will be subject to regulatory approval.

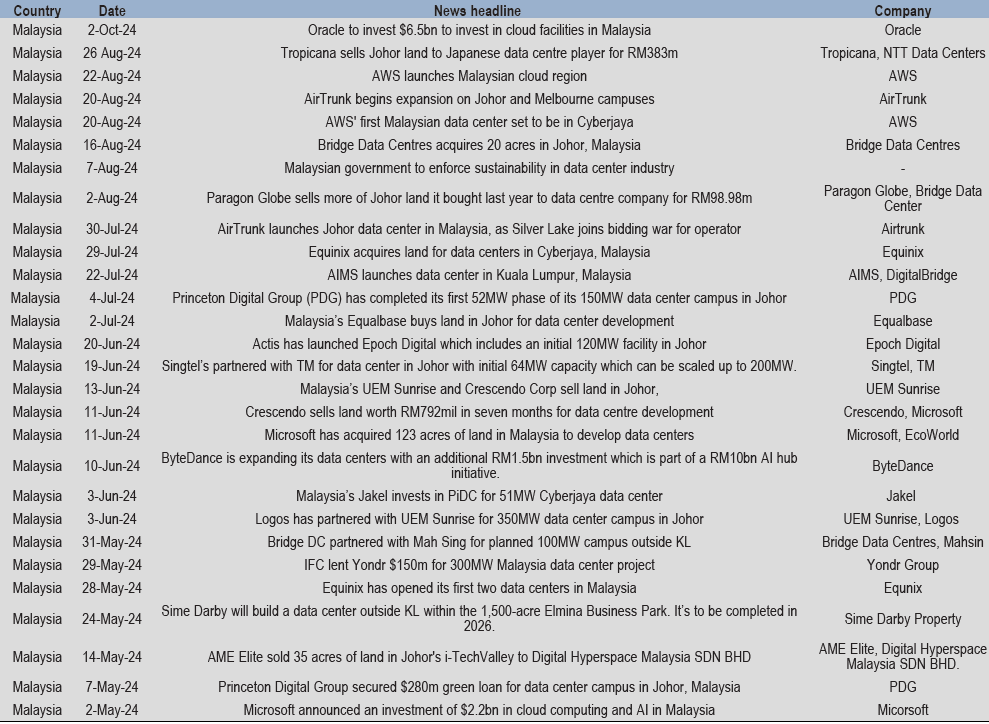

Recent data centre developments

Source: datacenterdynamics.com / JP Morgan

Word of caution

While 4D is excited about the long-term infrastructure investment thematic underpinned by the anticipated growth in data centres, it’s worth noting that this growth in investment and or demand will not be immediately realised in numbers. It takes time to plan, locate and build data centres, and this time lag flows to the execution of generation capacity, grid connections and load demand. It also must be financed by investors through debt and/or equity. As such, the reality is that the thematic, while potentially game -changing, will not start really moving numbers for a number of years. And while supportive of valuations, shareholders must be patient in the realisation of the opportunity set.

Conclusion

The market is excited about the potential of AI and the ever-evolving technology thematic, as are we. We truly believe that the technology revolution is a multi-decade investment opportunity for infrastructure investors – the need for communication towers and the facilitation of energy central to data centre development and the proliferation of AI are incredible global growth dynamics. At 4D, we are capitalising on this significant opportunity through investments across the infrastructure names geared to the theme (e.g. Iberdrola & Dominion Energy, as well as Cellnex in the tower space).

However, there is the potential for misallocation of capital, and/or sub optimal financing, which minimises returns on investment, potentially impairing shareholder value. To avoid this, we recommend active positioning.

The content contained in this article represents the opinions of the authors. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] A data centre rack is a framework that is usually made from steel and houses servers, cables, and other equipment. The servers can fit neatly into the framework, helping to keep them organised and safely off the floor. The standard height is seven feet.

[2] Cloudscene platform

[3] Santander Thematic Alpha Research: Data Centers' Exponential Growth and Opportunities for Brazil; 10/07/2024

[4] Global Clean Power: At a Tipping Point; Morgan Stanley; 29/09/2024

[5] Data centres, Generative AI & Power Constraints: The Path Forward; TD Cowen; 28/05/2024

[6] Amazon buys nuclear-powered data centre from Talen; Nuclear Newswire; 08/03/2024

[7] The “Eastern Data and Western Computing” initiative in China contributes to its net-zero target; Ning Zhang, Huabo Duan, Yuru Guan, Ruichang Mao, Guanghan Song, Jiakuan Yang, Yuli Shan

[8] as at 23/09/2024

[9] Contango is when the futures price of a commodity is higher than the spot price. This indicates that investors are willing to pay more for the commodity in the future

[10] Data centers, Generative AI & Power Constraints: The Path Forward; TD Cowen; 28/05/2024

[11] IEA: Data Centres and Data Transmission Networks

[12] Iberdrola is working on a joint venture to promote data centres in Spain and other countries; America Economia; 16/09/2024