This is the abridged version of the article, which can be read in full here.

With ongoing political and macroeconomic uncertainty in the US, exacerbated by the federal election being held later in November, 4D visited the US to understand what fundamental impact these had on infrastructure earnings and how management teams were navigating the uncertain waters.

Despite some challenges, infrastructure investment is absolutely needed across the US. This investment should support consistent, predictable earnings growth for investors over the long term. The defensive qualities of infrastructure should also be increasingly favoured by investors, should the US experience financial difficulty and weak (or negative) growth.

In this piece, we highlight some interesting themes and observations from the trip that support our views on the region.

Politics

The upcoming presidential election dominated media headlines while visiting the US, with the November contest expected to be very tight. Anecdotal conversations indicated that domestic concerns mirrored international concerns, including:

- the ability of President Biden to complete another four-year term given his perceived deteriorating mental capacity, and

- concerns from moderates as to the intentions of Donald Trump if he were to win a second, and final, term in office, given his refusal to accept the official results of the previous election, and support of and for autocratic leaders.

Policy differences

The leadership of Biden vs Trump couldn’t be more polarising in their approaches to diplomacy, as well as their policy prerogatives. While Biden and the Democrats are focused on implementing the energy transition, increasing regulation of the technology and finance industries, and supporting conditions of lower income and working-class people (including continued support of the Affordable Care Act), Trump is focused on supporting the exploration and production of traditional fossil fuels, reducing regulation and red tape, and extending the 2017 tax cuts he implemented in his first term. Their competing policies are summarised below.

Of the above issues, some are particularly relevant to the infrastructure investment proposition:

Taxes – Trump’s Tax Cuts & Jobs Act (TCJA) of 2018 reduced the corporate tax rate to 21%, reduced tax rates of all individual income tax brackets (significantly supporting highest income earners), and cut the lifetime estate/gift tax exemption in half. The reductions are scheduled to expire in 2025, but it’s widely believed both candidates would look to extend them to some degree, putting upward pressure on budget deficits and inflation. Biden is expected to extend some form of tax cuts, but probably not the current state of affairs. It’s expected that Trump will be particularly supportive of extending the full suite of tax reductions.

Tariffs – Biden is likely to maintain tariffs on select Chinese goods and support onshoring of manufacturing back to the US. Trump has communicated the potential for a universal tariff of 10% on all imports, and 60% on Chinese goods. The economic impacts of this could cause stagflation for the US economy[1].

Energy – Trump has communicated that he intends to repeal Biden’s Inflation Reduction Act (IRA) which supports renewables, cleaner/green energy sources, and Electric Vehicles (EVs) through tax credits. Commentators suggest he may only repeal the support for EVs from the bill. He has also communicated the intention to support drilling for traditional fossil fuels in oil/gas, potentially through Federally streamlining the permitting process for drilling and pipeline development. This move could be detrimental to operators investing in the energy transition (utility sector).

Further information and other key themes on politics can be found in the PDF version of this article.

Economics

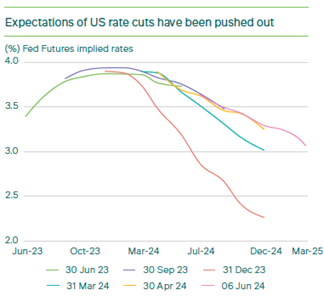

2024 dawned with the market pricing in significant rate cuts throughout the year. In our 2024 outlook article published in January, we highlighted that “the market had once again got ahead of itself in pricing in such aggressive rate cuts so soon, and there is was a high chance of rate cuts being pushed into the second half of 2024, as central bankers wait for a more sustained period of lower inflation, which should structurally settle higher than pre-pandemic periods.”

In the first half of 2024. inflation, whilst on a downward trajectory, plateaued above the communicated target of the Federal Reserve of 2%. And, as expected, interest rate cut predictions were pushed out from the first half of the year to August/September 2024.

Source: Bloomberg

This initially didn’t impact utility company share valuations, but more recently have contributed to poor performance of the utility price index, Utilities Select Sector SPDR Fund (the XLU).

XLU performance for the past 12months to 16 July 2024 – shows improving performance to late May 2024, and a pullback more recently.

Source: FactSet

Despite stickier inflation than was anticipated at the start of the year, and interest cuts being pushed out, recently there have been indicators of a softening job market and increasing credit delinquencies. GDP growth has been hovering at a healthy 3%, but these indicators could be pointing to harder economic times in the US and potentially a recession (markets currently assuming a 50% probability). A cut in interest rates by the Fed could ease financial conditions, but could get ahead of itself, leading to inflation either not reaching the communicated Fed target or increasing again – putting more pressure on consumption.

Fundamentally, in the event of a recession, the defensive qualities of infrastructure companies should result in a rotation from the investor-loved growth stocks (such as the technologically-focused ‘magnificent seven’), to more defensive sectors, such as utilities and communication towers. However, should the US experience stagflation rather than a recession, the increase in inflation and interest rates could negatively impact valuations of infrastructure names (through increased discount rates) resulting in a different market reaction.

As outlined above, political policy between Biden and Trump seems to vary widely, although neither candidate’s policy is likely to reduce budget deficits, and both are likely to be inflationary. A BlackRock report recently stated, “we track potential changes on US trade, immigration and energy policy – and see a potential inflation boost no matter who wins[2]”. This represents a macro risk to investments and something we are monitoring closely.

The feel for economic conditions while visiting the US was of cautionary optimism. As a traveller from Australia, everything felt very expensive, more so than previous trips, although US wages have increased significantly, which has compensated (at least partially) for the increase in domestic prices. People were out spending, but it’s unclear if this was to be maintained.

Electricity and gas regulated utilities

Turbo charged load demand

The core message from many electric utility companies was the expectation for strong power load demand growth driven by a combination of factors depending on the state jurisdiction. These include:

- Net population migration inwards (this could obviously be negative for some states),

- Increased manufacturing (especially from tech companies supported by the CHIPS Act),

- Electrification (transport, space heating, and the oil/gas industry),

- Data centre demand and the energy needs of artificial intelligence (AI).

Despite management teams’ enthusiasm for load demand, investors were unclear on the impact on the investment proposition of infrastructure companies. The questions centred around – whether utilities could grow earnings at 4-8% during a period of benign or flat load demand growth, and if load growth is expected to be high single digits, then shouldn’t we expect much higher earnings growth? The resounding feedback from utility management teams was – increased load demand growth is expected to support the investment proposition of utilities, not change it.

Regarding demand driven by the development of data centres specifically, management outlined caution. It was felt that some of the demand being communicated by tech companies developing data centres such as Amazon, Meta, Microsoft and Google would not come to fruition. To the degree that utilities made investments in generation and/or the network to facilitate this load, and it didn’t eventuate due to a decision by the tech company, the cost of that investment would be spread over the remaining customer base – negatively impacting affordability of regular residential customers. This is a major concern for regulators and hence utility companies.

Utility companies are adopting various mitigants to ensure that residential customers don’t take on the cost of investment to facilitate data centre load. Some companies spoke of adopting specific tariff structures for data centres, which had them pay for the incremental generation capacity to support their load, as well as a contribution to network investment. This required regulatory approval to implement. Most, if not all, utility companies required data centre developers requesting significant incremental power to sign long term contracts with take-or-pay provisions, which meant that if the demand didn’t eventuate or didn’t last, the tech company would be required to cover the cost. Utility management teams felt that if these mitigants were adopted, the incremental demand from data centres has the potential to support regular customer affordability by splitting shared network costs over a larger customer base.

Fundamentally, increased load growth supports customer affordability (reduces regulatory risk); enhances investment programs; and should support earnings growth if implemented correctly. Companies are unlikely to increase their earnings guidance significantly due to the cost of equity financing, and potential regulatory scrutiny. However, they could outperform to the upside on a fairly consistent basis.

Further information and other key themes on electricity and gas utilities can be found in the PDF version of this article.

Water utilities

Regulatory scrutiny

Water companies across the US are facing a busy regulatory calendar through 2024. In particular, for jurisdictions such as Pennsylvania and New Jersey, the media had reported on discontent communicated by customer representative (intervenor) groups in their response to filed rate cases by companies such as American Water. Their discontent was focused on customer bill increases implied by the rate case filings.

Management teams of water utilities outlined that it was the usual course of action that these customer representative groups communicated discontent in response to proposed customer bill increases. They said that this has historically not impeded companies achieving constructive regulatory outcomes, and that the increased media coverage of the intervenor testimony was probably the new normal. They outlined the US being in an election year could be the driver for increased media coverage – the cost of living being an election theme.

Despite the increased media attention, there were examples where water companies were achieving constructive regulatory outcomes. American Water received a constructive regulatory decision from the Administrative law judge (ALJ) in Pennsylvania, recommending revenue increases of around 60% of the company’s requested increase. Additionally, in late June, SJW Group received a final decision on its rate case filing in Connecticut, which allowed for an increased return on equity of 30 bps to 9.3% (this could be improved with achievement of certain performance metrics). This outcome was far superior to other water companies in the state, such as Aquerion, which had received an allowed return on equity of 8.7% in March 2023.

It was also clear from discussions with management that the need for investment in water networks was still very strong. The Environmental Protection Agency (EPA) had implemented new water quality thresholds regarding PFAS (including PFOA and PFOS) chemicals, or ‘forever chemicals’, in US drinking water supplies. Achieving this threshold, of 4.0 parts per trillion (ppt), requires significant investment and ongoing management on behalf of water companies, which management teams suggested was very achievable. The EPA was also considering Lead and Copper Rule Improvements (LCRI), which looked to identify and replace lead and galvanised water lines by 2037. Water companies believe the investment requirement to implement the renewed LCRI is understated by the EPA.

Irrespective of the deadline adopted by the EPA (if any), it’s clear that massive investment is required to replace lead pipes, and water companies want to ensure that it’s facilitated while maintaining affordability for customers.

Further information and other key themes on water utilities can be found in the PDF version of this article.

Midstream oil/gas

Long-term natural gas utilisation

While passing through Houston, TX and Tulsa, OK, I met with a number of midstream (pipeline) oil/gas company management teams. They were generally optimistic regarding prospects driven by their belief in the long -term requirements for natural gas and refined products, combined with their current healthy credit positions and cashflow generation.

At the time of visiting, spot natural gas prices were around $2.50/MBtu, but the forward curve represented strong contango. Management teams outlined that the upward trajectory in expected natural gas prices was probably supported by increased domestic and liquefied natural gas (LNG) demand through the back end of 2024 and into 2025. Although realisation of these higher gas prices was continually being pushed out and were somewhat mitigated by high gas storage levels. Current levels are approximately 500 Bcf higher than average, and would take some time to dissipate for gas prices to escalate.

Irrespective of the short-term demand dynamics for natural gas, companies were aligned in believing that natural gas would be part of the energy mix in the long term, and an essential part of the energy transition process. Gas generation would support the rollout of renewables in addressing their intermittency, which would require the continued build out of supporting infrastructure.

Predominantly, this required investment would be in capacity increases on major transportation pipelines and within storage assets. This trend is only exacerbated by the expected electrification dynamics and increasing demand from tech manufacturers and data centres.

Further information and other key themes on midstream oil/gas can be found in the PDF version of this article.

Communication towers

To varying degrees, the three US communications towers in 4D’s investment universe have experienced poor share price performance in recent years due to coinciding factors, including increasing interest rates; the negative cashflow impact from customer churn; and concerns regarding the ability of mobile network operator (MNO) customers to invest in upgrading networks to facilitate 5G. It seems the investment proposition of towers is still intact over the long term, but the short term presents challenges.

Mobile network operator activity

SBA Communications (SBA) and Crown Castle expect a continued drag on cashflow growth due to churn associated with the T-mobile/Sprint merger. This churn occurs as contractual commitments end on tower agreements and T-mobile/Sprint look to rationalise their overlapping coverage post their merger in 2020. Management teams of the towers companies outlined that this is expected to be a headwind to cashflow growth in 2025 and 2026. It’s expected to be diminished/eliminated from 2027.

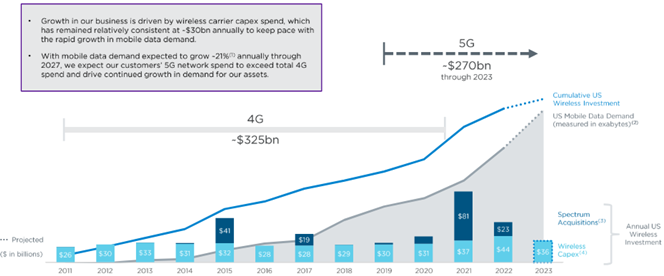

2023 represented a period of reduced MNO activity as a result of balance sheet stress, combined with a moderation in activity following a busy year in 2022 when MNOs quickly looked to establish 5G coverage, having just acquired high(er) frequency spectrum in 2021. This reduced the service-related revenues earned by the towers companies, and it also heightened market concern that the trend of growing cashflow generation from 5G wasn’t going to be sustained.

The graph below shows the 2023 wireless capex of the MNOs was actually around the longer-term average, and despite being lower than 2022 (following the 2021 spectrum auctions), there is no sign that the 5G rollout will end.

Indicates MNO spectrum and wireless investment for 4G and 5G roll-outs

Source: Crown Castle

More recently, there have been signs that the MNOs have increased activity slightly in rolling out 5G coverage. AT&T are continuing the rollout of its 5G coverage, while T-mobile has achieved coverage across most of the US, and over time will look to increase density to facilitate higher 5G data uses.

Further information and other key themes on communications towers can be found in the PDF version of this article.

Still optimistic on US infrastructure investment opportunities

As the markets wrestle with the timing and magnitude of interest rate cuts, this will no doubt feed into US infrastructure valuations over the second half of 2024 and into 2025. The fear that politically motivated fiscal policy could ignite inflation and put upward pressure on interest rates again is a risk to valuations.

In addition, markets currently believe there is roughly a 50% probability that the US economy encounters a recession. The earnings resiliency of infrastructure stocks would presumably be appreciated by investors as compared to other sectors if this scenario plays out.

Based on conversations with infrastructure company management teams, investment prospects for specific sectors vary, with different dynamics influencing earnings potential.

- Electricity and gas utilities: the need for investment has arguably never been greater, and is based on increasing load demand, continued decarbonisation efforts and the need for asset replacement/hardening to support reliability. Affordability is still very much in focus, but correctly managing increasing load demand can help alleviate this.

4D likes –Sempra.

- Water utilities: noise around regulatory risk has been over emphasised, and the achievement of constructive outcomes should alleviate this with time. The need for network investment to improve water quality and replace ageing assets is outweighing concerns around affordability. Consolidation is still perceived by legislators and decision makers as important for the sector.

4D likes – American Water.

- Midstream oil/gas: future price curves point to improving natural gas prices, which would be supportive of organic volume growth on midstream networks. Irrespective of volume growth, pipeline and storage investment required to support increasing peak loads continues to be required. Free cashflow generation is very attractive and allows for value accretive M&A and/or share buybacks.

4D likes – Williams Co. - Towers communication: cashflow growth is challenged in the short term due to churn driven by MNO customer consolidation, moderating MNO rollout of 5G, and the higher cost of refinanced debt. The longer-term investment proposition regarding organic earnings growth and strong cashflow is still intact.

4D likes – not invested at this time.

Despite the macro and geopolitical uncertainty, as well as certain company specific risks, we believe there are still some very attractive investment opportunities in the US infrastructure market, and the recent trip reinforced this view.

We remain focused on companies that offer attractive valuations and exhibit stable earnings, predictable cashflows and have quality management teams.

[1] Can Trump replace income taxes with tariffs?; Kimberly Clausing and Maurice Obstfeld; Peterson Institute for International Economics; 20/6/2024

[2] Weekly Commentary: What we’re watching in 2024 elections; BlackRock; Jean Boivin, Wie Li, Christian Olinger, and Ann-Katrin Peterson; 10/06/2024

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.