We predict 2025 will be a year of moderating growth, inflation and rates. We move from a year of elections to a year of policy implementation, and there is no incoming government more consequential than Trump 2.0 - particularly in its impact on the domestic economy, key trading partners and geopolitics.

In this article, Tim Snelgrove (Investment Director) and Sarah Shaw (Chief Investment Officer and Global Portfolio Manager) discuss the key economic factors shaping the current landscape. They also consider recent developments that could impact the global economy over the medium to long term and examine what this means for infrastructure investors and 4D’s portfolio.

2024 year in review

“2024 is set to be a pivotal year for the global economy, as we move past peak rates, growth moderates, and inflation continues its downward path to central bank target bands.…. Worryingly, with inflation moderating faster than expected in the US and Europe, expectations of sizeable rate cuts have already been priced in by the market for 2024.…. We believe that the market has once again got ahead of itself in pricing in such aggressive rate cuts so soon, and there is a high chance of rate cuts being pushed into the second half of 2024. We feel that the Fed is likely to cut rates faster only with a substantial economic slowdown, which is certainly not predicted in growth forecasts.”

“In our view, the macroeconomic challenge for 2024 is one of perfecting the descent from the highest interest rates in a quarter of a century – continuing the path of disinflation towards central bank targets without being excessively contractionary for too long to cause a hard landing…. The market is pricing in a soft landing in the US, core inflation back to target band and March rate cuts – a Goldilocks outcome – if we get there. We are not as optimistic.”

Despite years of restrictive monetary policy, growth in 2024 held up and US exceptionalism continued particularly in contrast to Europe. We also saw a key shift in central bank focus from managing upside inflation risks to managing downside growth risk, and monitoring cooling labour markets. Central banks did kick off their easing cycles later in the year, for what was to become a short and shallower rate easing cycle.

On the geopolitical front, 2024 was a year of elections with 40% of the population going to the polls. Indonesia saw a broad continuation of prior government policies, whilst in India Modi was re-elected without the comfort of a majority. In Mexico, Sheinbaum exceeded the most optimistic forecasts, winning a super majority and controlling both houses of government. France and Germany remain under political upheaval, mired with weak government debt and fiscal deficits and an unwillingness to push through budget cuts. The UK saw a return to Labour government, with Starmer winning a landslide election after 14 years of conservative government. By far the most controversial and consequential election was the return of Trump, winning the US election in November by a convincing margin (more on this later).

In summary:

-

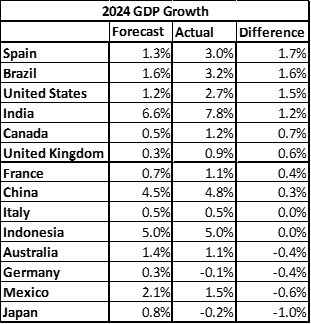

Growth: The US economy powered ahead in 2024, growing 2.7% vs 1.2% expected at the start of the year. Eurozone growth was 0.8%, with severe divergence between countries with Spain (+3%) growing strongly compared to a muted Germany (-0.1%) and France (+1.1%). China slowed in 2024, but beat expectations, while Brazil surprised to the upside (+3.2%). Global manufacturing orders remained historically weak. Excess savings have only been drawn down in the US and Australia.

4D GDP growth forecasts from 2024 Outlook vs actuals, ranked by outperformance

(Source – 4D 2024 Outlook paper, Bloomberg)

-

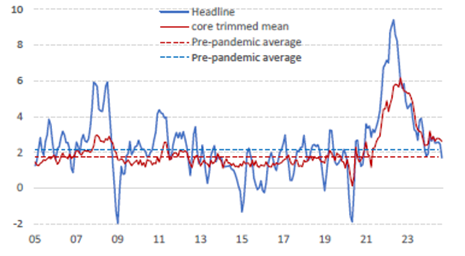

Inflation: Inflation has largely returned to target. Global core inflation is running 90bps annualised above pre-pandemic averages, with goods inflation broadly flat or below zero. China is suffering from stubbornly low levels of inflation which is impacting household, business confidence and spending. Goods deflation remains close to zero in most economies, with stubborn services and wages inflation starting to ease.

Monthly annualised run rate of global inflation %

(Source – UBS)

(Source – UBS)

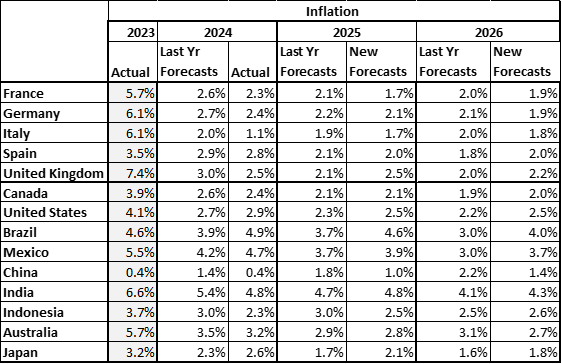

Path of inflation towards target; 4D inflation forecasts from 2024 Outlook vs actual

(Source – 4D 2024 Outlook paper, Bloomberg)

-

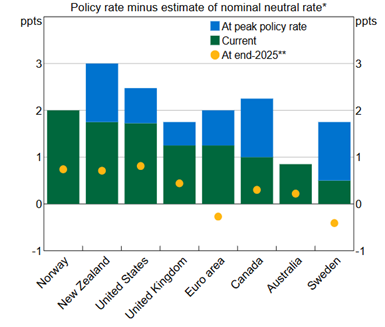

Policy rates: Policy rates in most economies have started to be cut in 2024 but remain in restrictive territory. Europe was among the first of the main central banks to cut rates in 2024, with wage pressures subsiding. Despite the substantial cuts already occurring in the US, UK and Europe – rates are still expected to remain in restrictive territory at the end of 2025.

Estimate of central bank policy restrictiveness

(Source - Reserve Bank of Australia)

-

Yields: Despite lower cash rates with several central banks starting their easing cycles, 10 year yields mostly ended higher by year end. This was due to higher expected terminal rates, driven by higher fiscal spending and debt concerns.

10 year bond yields over 2024

(Source – Bloomberg, 4D)

2025 Themes

As we look ahead to 2025, we expect moderating growth, inflation and rates.

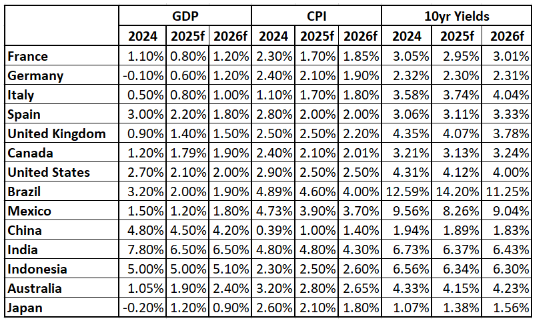

4D Economic Forecasts

(Source – Bloomberg, 4D. 2024 is actual or latest consensus if not released)

Trump 2.0

The new Trump Administration in the US is a major wildcard for the year ahead, both economically and geopolitically, with implications home and abroad. Whilst Trump’s main campaign policies and threats are known (tariffs, taxes, immigration, deregulation) – the degree of implementation and timing are still fluid. Overall, these factors suggest a scenario of higher nominal U.S. growth, elevated inflation, and favourable domestic drivers for corporate earnings, tempered by the potential downside risks from global trade tensions and geopolitical instability. Outcomes are very uncertain with higher downside risk.

- Tariffs

In 4D’s October 2024 News & Views “Tariffs; The Impact on Infrastructure”, we analysed the impact of potential Trump tariffs on the economy, its impact on inflation and infrastructure sectors. We wrote:

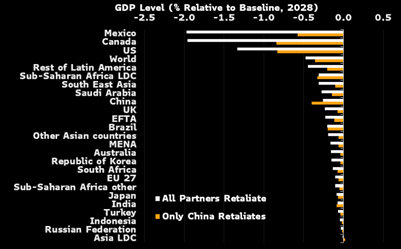

“Trump is proposing the largest tariffs since the 1930s, and customs duties seven times those of the Trump 1.0 trade wars in 2017-19. There are many variables and uncertainties, however, on their own, Trump’s tariffs will primarily impact growth domestically, as well as in Mexico and Canada, and have upside risk to US inflation. Global trade will reduce between the US and China – but bystander countries should pick up the void of these import and export volumes. This leads to new winners and losers from an economic point of view, and in global trade market share – and with that, ports who move these goods.”

The impact of tariffs is stagflationary on the US (lower growth and higher inflation) but there is a very wide range of potential outcomes. Tariffs are a tax on imports, which will slow economic activity as demand slows. Firms may pass on tariff related expenses to the end consumer, resulting in a kick up in inflation; however, this may be short-lived if tariffs are reduced in the future.

The timing and size of tariffs are still uncertain, as is the degree of bilateral negotiations and sector exclusions. The current headlines are opening gambits and form part of Trump’s broader negotiating strategy, all with the aim of increasing FDI and manufacturing activities into the US. Trump’s biggest targets are those countries with large goods trade surpluses with the US, which include China, Mexico, Canada and to a lesser degree Europe.

We expect a China tariff to be implemented in late 2025, with a universal baseline tariff (UBT) in 2026, but with several exclusions and amendments in place. There is less clear footing on the implementation of the UBT and there is the widespread expectation based on input from Trump advisors that Trump will use the threat of the 10% tariff to negotiate concessions with major trading partners, rather than imposing them indiscriminately.

Bloomberg’s Tariff Model, Impact on GDP growth vs baseline

(Source - Bloomberg)

It is important to consider how US trading counterparties react to tariff proposals and negotiations (e.g. Australian permanent exemption from Trump’s 25% steel/aluminium tariffs in 2018). As to impacts on countries, a 10% UBT will hit Europe 0.5-1% GDP growth, with the biggest hit in Germany. Trump has also proposed larger tariffs on European auto’s, further hurting Germany. Weaker exchange rates will act as a safety valve for EM exporters facing US import tariffs. The biggest impact in the EM is on Mexico (0.5% GDP) due to its supply chain integration with the US. Longer term manufacturing orientated EMs (Vietnam and Mexico) could benefit from a shift by Western firms pulling production out of China. The first trade war had little impact on aggregate export performance in China, as third party countries replaced US destinations and with CNY depreciation. This time round, any weakness should be met with additional Chinese stimulus in line with its gradual approach of stimulus and meeting annual growth targets.

Uncertainty remains, and as per UBS “at a minimum, a return to US diplomacy by social media posts and tariffs suggests a new period of heightened cross asset volatility may be ahead”1

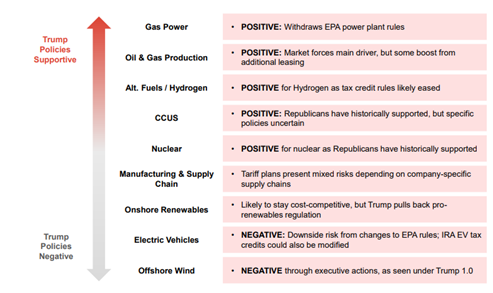

- Deregulation – Energy & IRA

Trump’s campaign trail was pro fossil fuels and against renewable build out.

(Source – Evercore ISI)

Trump is supportive of domestic oil and gas production, as well as undoing Biden’s pause on new LNG export terminals. The pause only applies to projects that would come online at the end of the decade, so the effect on natural gas prices will be negligible in the short term. Several liquification terminals, that already have approval to export, are scheduled to begin operations over the next few years.

By contrast, Trump has threatened to repeal the Inflation Reduction Act (IRA), but there is a high degree of unknowns as to what and how much can be done. A full repeal is less likely because of the large amount of IRA related investments made in Republican dominated districts. According to the Department of Energy, of the total spending on clean energy technologies since 2021 (as of mid-2024), ~$10.9 billion was for solar in red states and $4.1 billion in blue states, spending on batteries was $109.9 billion in red states and $22.0 billion in blue states, and spending on EVs was $35 billion in red states and $4.2 billion in blue states. However, it is clear that the near term rhetoric is negative with comments such as “no windmills” impacting sentiment.

- Immigration

Trump’s threatened immigration agenda is very aggressive, including deporting 15-20 million people immediately and stricter border controls. Trump will most likely repeal Biden’s “humanitarian parole”, which is bringing in 75 thousand people monthly into the US with the ability to work after 30 days – this will cut off a major source of labour force growth and be potentially inflationary. Immigration has been an important tailwind to recent US growth having been about 2 million above trend in recent years. Net immigration reducing to near zero and deportations of undocumented migrants should reduce the US labour supply by 0.1-0.2%. It is also important to note that Trump 1.0 ran on mass deportations, but the pace of his deportations were actually lower than Obama.

- Taxes

Trump’s other policies are domestic growth focused, with tax cuts giving consumers further tailwind and a push to re-invigorate the domestic manufacturing base and re-shore facilities back to the US. The negotiation around the 2017 Tax Cuts and Jobs Acts (TCJA) looms large in 2025, and the potential economic impacts on fiscal policy are more likely to be felt in 2026.

These tax cuts are at the cost of widening the fiscal deficit and estimated to add nearly USD $5-10 trillion to overall debt over the next decade, even with the offsetting gains from government efficiency and tariffs. Rising net interest payments continue to increase and there is little fat to cut from the budget (only 14% is discretionary non-defence spending to trim) – this could lead to discomfort in the bond market.

The bond market is likely to be more important to Trump 2.0 considering the current levels of debt and intended fiscally expansive policies. Ahead of his first win, the 10-year treasury yield was ~1.8%, the US federal deficit around 3% of GDP, and the outstanding debt ~75% of GDP. Today, those numbers are ~4.4% on Treasury yield, and ~7% & nearly 100% of GDP, respectively. There is a risk of the ‘bond vigilantes’ returning to the US should the fiscal deficit and trajectory get reckless.

- Timeframe & risks2

Considering the many parts of Trump’s agenda, a number of conflicting dynamics mean there is a wide range of distribution of risks around outcomes, with what we believe a fatter tail risk to the downside.

We expect a focus on immigration in the first 100 days (border security, deportations, reverse Biden’s humanitarian visas). There should be tariff noise all of 2025, with China tariffs implemented in the second half of the year and UBT introduced in 2026. Tax cuts should be extended by the end of 2025.

There are still some controls over Trump’s policies, which should rationalise outcomes. His immigration and tariff plans can largely be implemented through executive action, whereas his regulatory rollback can proceed more rapidly with Congressional cooperation, and his tax plans are entirely dependent on Congress. Congress controls the US budget, and has sole authority to pass legislation (required for tax cuts). Even a Republican sweep will exercise a level of control, even on the most extreme aspects of policies (e.g., a Republican Senate did reject extreme Fed nominees in Trump’s first term).

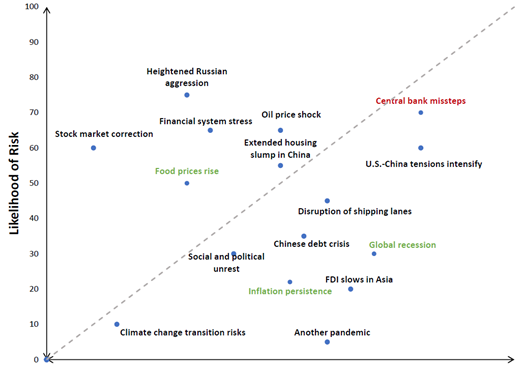

Geopolitics

Geopolitical risks should continue to cause volatility in 2025, but it’s economic impact will remain uncertain. The election cycle of 2024 gives way to policy implementation in 2025, and with this comes increased geopolitical uncertainty from Trump’s foreign policy stance, position on trade, immigration and the war on drugs.

Trump will no doubt be highly consequential for existing conflicts, where he is trying to strong-man his way to resolutions (in the Middle East and Ukraine), and an unknown for those that have been simmering for years (China-Taiwan, South China Sea conflict, Red Sea conflict).

Tariffs are likely to be used as weapons of foreign policy, and the level of retaliatory tariffs have significant economic and geopolitical consequence (such as in Mexico). These have the risk of flowing through to renewed supply chain disruptions, which could bring upside risk to inflation.

Moody’s Key Geopolitical Risks

(Source – Moody’s Analytics. Red indicates increased severity and/or probability of risk; Green indicates decreased severity and/or probability of risk.)

What does this mean for infrastructure?

We believe that infrastructure, as an asset class, can always play a vital role in portfolio construction due to its unique characteristics such as inflation passthrough, visible and resilient contracted or regulated earnings profiles, and exposure to numerous long-dated growth thematics.

The 2025 economic outlook lays a solid foundation for infrastructure investing. Growth in key markets remain solid, albeit cooling after a strong 2024, inflation continues to cool in most markets to target and central banks have kicked off their easing cycles.

Beyond the economic footprint, the political overlay remains uncertain. Of most note for infrastructure is Trump’s tariff plans, their size, range of impact and timing of implementation. Within the infrastructure universe the most impacted from tariffs are port and rail volumes in both export and import countries. Some volumes will be pulled forward ahead of the anticipated tariff increases, whilst some export markets will be substituted with other destination markets away from the US. The biggest near term opportunity/risk is within North American rail, due to exposure to port volumes and intermodal traffic as well as Mexican export exposure. Longer term, negative volume impact may be offset by greater onshore manufacturing activity as well as import substitution, albeit this takes time. At 4D Infrastructure, these dynamics see us favour the East Coast rails who we think are best positioned to mitigate the risks and capitalise on the opportunities. For the ports we could see changing trade partnerships and activity benefiting different regions and types of ports (containers vs commodities). For example, we see the Brazilian ports a net beneficiary.

On the deregulation and energy policy front, there is uncertainty around the potential repeal of some aspects of the Inflation Reduction Act (IRA). Any repeal could impact the growth outlook of some heavily US renewable focused developers and utilities and we expect an ongoing overhang till we see what is exactly implemented. As such, we have limited our exposure to the pure-play renewable sector to one name which has been oversold on the sentiment and is the least exposed to Trump’s target sources such as offshore wind. Within the broader US utility sector, we favour those capitalising on the grid opportunity for growth as opposed to a reliance on renewable expansion. By contrast, this pivot away from renewables and Trump’s preference for traditional fossil fuels may be positive for North American pipelines if more federal lands are permitted for exploration. This is a sector that out-performed in 2024 to see it currently offering limited value without factoring in blue sky opportunities. However, we continue to position where possible for this upside.

Secondly, there is the potential economic impact in the US from the increased inflation risk posed by tariffs and the higher fiscal burden, which could influence the future trajectory of rate cuts and yields. We enter 2025 with the Fed and the market expecting a short, shallow easing cycle with only one to two more rate cuts for 2025 and a higher terminal rate reached during the year. Unlike 2024, we see this market pricing realistic. Higher inflation, higher yields and higher end rates are a headwind for the nominal rate US utility stocks as they are unable to immediately pass on the economic scenario with earnings fundamentally impacted. This sector had a very strong 2024 as a result of a supportive inflation and rate trajectory, as well as a strong investment tail wind from the data centre thematic. While the latter is real and very exciting for the global utility sector in general, we feel that some names may have gotten ahead of themselves given the current headwinds presenting in 2025, namely Trump and economic strength.

More topically for the US utilities, the current devastating Californian wildfires have again highlighted the risk to utilities in the US and in particular the West Coast and California, of the increasing environmental risk from fire. Regardless of prudent operation and mitigation of fire risk, utilities are increasingly exposed to not only the risk of liability for wildfire ignition but the longer term legal, economic and social consequence of the aftermath and limitations on potential recovery, investment and bill increases. While we see high quality companies operating in the impacted regions, we have as a result of the current fires, revisited our exposure due to these headwinds which we believe demand a higher risk premium.

We remain conscious of the uncertainty of Trump’s administration as he is set to take office – but are mindful that predicting his every move is a fool’s game. We look to separate the resilience of the infrastructure asset class from this noise, and while we remain optimistic about the long-term fundamentals underpinning the infrastructure investment case, we are positioning into 2025 for the discussed headwinds and tailwinds.

Away from the US, we continue to see real opportunity in the European utility space as the rate trajectory remains supportive and the investment pipelines continue to grow exponentially. We have core exposures to the grid sector across mainland Europe and the UK. Importantly, in the UK the risk of stagflation is largely hedged by the utility space with an explicit annual inflation uptick within the regulation. Recent share price weakness on Gilt moves we believe is a buying opportunity.

European user pays also continue to offer value. While volume growth is mitigating, it remains solid, and the strong cash generation and growing shareholder returns are attractive in the current muted economic environment.

China continues to be plagued by a weak property sector, but unprecedented coordinated stimulus pledges in September 2024 indicate potential upside policy risk for China in 2025. All eyes are now on the ‘Two sessions’ meeting in March and how the Central government responds to the return of Trump. We remain selective in our exposure to China, capitalising on those names that can benefit from the stimulus as well as a slowly recovering sentiment.

In Latin America, Mexico is at risk of Trump 2.0 and we are limiting exposure to those names that have low exposure to tariffs, can capitalise on a weakening currency and are not on the radar of the new Mexican government, namely the airport space. In Brazil, growth and inflation surprised to the upside in 2024 and the reversal of the rate trajectory to tightening territory and fiscal policy concerns, had a significant impact on sentiment for the infrastructure names. As a result, 2024 was a very weak year for Brazilian infrastructure equities which is at a complete disconnect with fundamentals (they all have an inflation hedge and many a GDP link which were both very supportive). As such, while we still see some remaining near term negative headwinds as President Lula’s refines his fiscal policy and as we await an interest rate peak, we think these are more than priced in with the Brazilian names offering incredible fundamental value at these levels.

Elsewhere around the globe we continue to monitor geopolitical risk and opportunity (China Plus One), the economic outlook (overweight user pays or utilities at a domestic level) as well as capitalise on long term, structural growth thematics that under pin the infrastructure investment story.

In summary, moving into 2025, we will be monitoring the regional economics and politics closely, and positioning ourselves to best capture these at an in-country level. At this stage we expect the following:

- Growth to moderate globally, but US to remain ahead of its developed peers.

- Whilst inflation continues to fall globally, there is upside risk (tariffs, supply chains).

- Trump’s China tariffs to be manageable, and upside risk to China with a positive stimulus response. Later in 2025 should see more detail on the UBT and various bilateral concessions given by individual countries to appease Trump, but there is a greater risk of it being watered down and delayed.

- Government debt levels and fiscal deficits will become an increasing concern from the bond market, not only polarising European governments (France & Germany) but there is a risk of higher US yields too with unfunded Trump pro-growth policies.

- Policy rates should continue to be cut, with a shifting focus on protecting growth and employment than inflation.

Outside these near-term influences, we also see five key and integrated growth dynamics within the infrastructure space that are long term, significant and completely immune to short-term economic events. We continue to position to capitalise on:

- Developed market replacement spend – our infrastructure is old and inefficient, and a failure to upgrade it could have significant social and economic consequences (health, safety, efficiency).

- The global population growth, but with changing demographics – the West is getting older, but much of the East younger. Both dynamics require increased infrastructure investment.

- The emergence of the middle class in developing economies, which offers a huge opportunity with infrastructure both as a driver and a first beneficiary of improved living standards.

- The energy transition that is currently underway – while the speed of ultimate decarbonisation remains unclear, there appears to be a real opportunity for multi-decade investment in infrastructure as every country moves towards a cleaner environment.

- The rise of technology and all the associated nuances of its use and impacts on infrastructure needs.

Conclusion

As we enter 2025, we see a moderating growth, inflation, rate outlook and Trump 2.0 as the main wildcard for markets. For the US, whilst Trump’s core policies are pro-growth there is now a greater degree of uncertainty, bigger downside risk and a wider range of possible economic outcomes. Trump’s tariffs and energy policies have the most direct impact on infrastructure companies, as does the new administrations wider impact on the economic outlook in the US, particularly the level of government debt, fiscal deficit, tax cuts and rate outlook.

However, infrastructure offers truly global exposure with assets across developed Asia, Europe and North America, as well as emerging markets. This allows us to capitalise on in-country economic cycles and gain exposure to domestic demand stories and/or mitigate the in-country risks. With market and economic trends currently diverging, certain regions offer greater relative value at present, and we are positioning for this. With the risk/opportunity of Trump incorporated into forecasts, we start 2025 overweight Europe and Emerging Markets with selective positioning in the US awaiting greater clarity.

Within the infrastructure space, we also have economic diversity which allows us to actively position at a fundamental level for all points of the economic cycle, even in periods of inflation and rising interest rates, recession, and stagflation. While a diversified portfolio is always optimal, active management of the two economically diverse infrastructure sub-sectors (essential services and user pays) at a country level, aims to smooth the volatility of equity investment and market cycles. We believe infrastructure is truly unique as an asset class in offering this portfolio flexibility.

At 4D Infrastructure, we continue to prioritise companies with strong leadership and defined strategic goals that integrate with a sustainability policy and strong balance sheets to support much-needed investment. We prioritise those that are best in class within their sector in countries with strong economic fundamentals, balanced risks and outlooks. We believe that with active management, a listed infrastructure equity portfolio can be positioned to take advantage of the long-term structural opportunity, as well as whatever near-term cyclical events may prevail – whether they be environmental, political, economic or social.

The content contained in this article represents the opinions of the authors. The authors may hold either long or short positions in securities of various companies discussed in the article. This commentary in no way constitutes a solicitation of business or investment advice. It is intended solely as an avenue for the authors to express their personal views on investing and for the entertainment of the reader.

[1] UBS ; “The CEO Macro Briefing Book”, December 2024

[2] For further detail on 4D’s expectations of Trump 2.0 and its impact on listed infrastructure and the economy, please contact us for our additional in depth research and analysis.